Payments

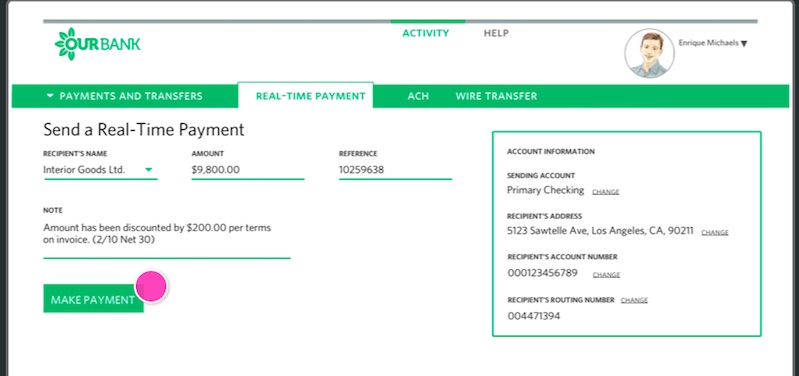

Catching up with the times, banks in the US are finally rolling out real-time payments

- U.S. Bank and BNY Mellon initiated the first real-time payment transaction Monday -- a test run for what's expected to become a standard for many business and consumer payments.

- Building the technology and customer service infrastructure to support real-time payments will delay implementation across the U.S. banking ecosystem.