Member Exclusive, Payments

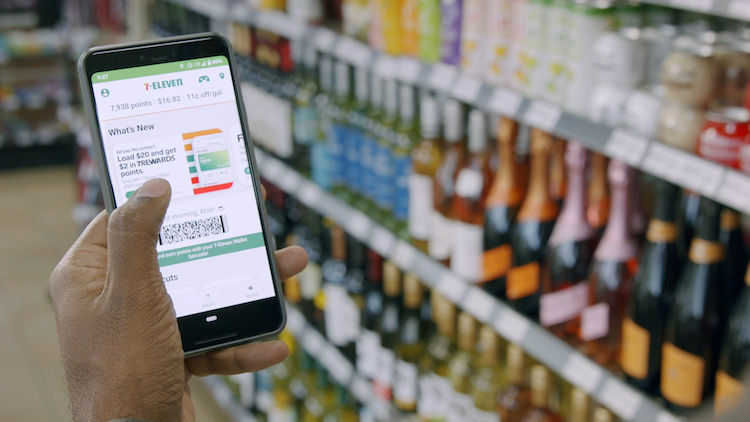

7-Eleven launches a mobile wallet

- Customers can now use 7-Eleven’s mobile wallet for direct purchases within any of the chain’s U.S. stores.

- Customers can fund their wallet both digitally and with cash