Consumers want digital receipts and subscription management. What does this mean for issuers and merchants and banks?

- FIs and merchants need to work on improving post-purchase interactions to build consumer loyalty and save on costs like chargebacks.

- Digital receipts and subscription management are tools merchants and banks can offer their customers to help them stay on top of their finances and also save on operational costs.

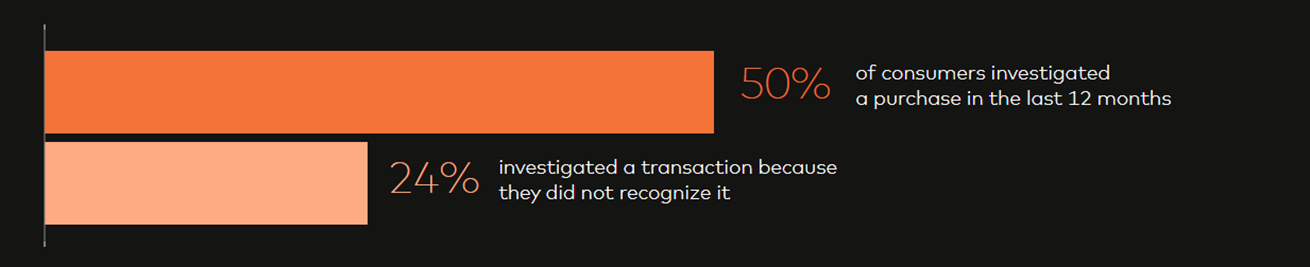

For the average person, keeping track of how their money is spent is a common activity. Here, having transactional information and purchase history is critical – it allows customers to remain vigilant and also quickly spot when something is amiss. 50% of customers analyzed a purchase in the last year, and 24% investigated a payment because they did not recognize it, according to recent research by Mastercard.

How merchants and banks can give consumers more insight into their purchases

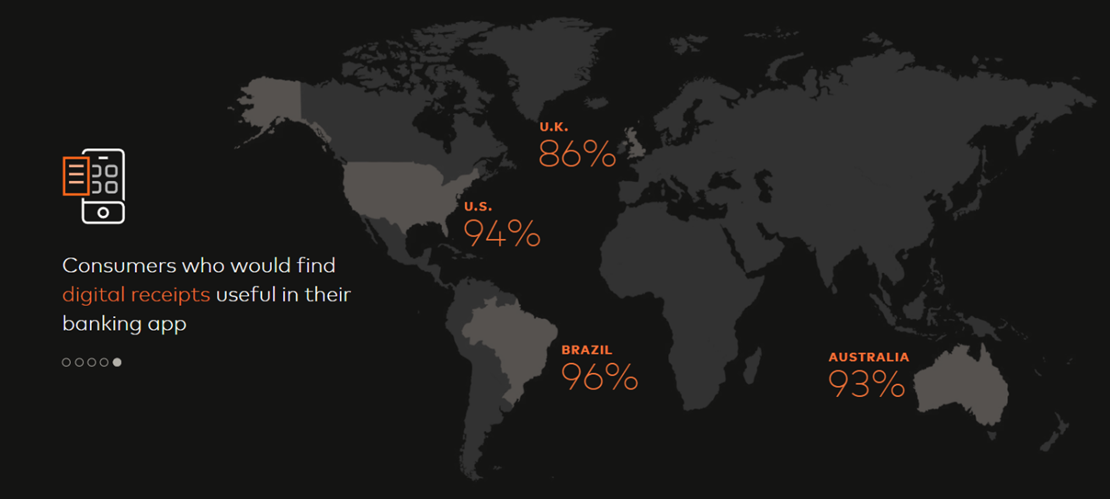

One of the easiest ways customers can track their spending is with digital receipts, which contain detailed information about transactions – but there’s also a growing desire from customers to have this information more centralized, like in their digital banking app. Digital receipts usually contain the full name and logo of the merchant, merchant’s contact, the prices of the items purchased and warranty information. 80% of consumers believe that easier access to this information would improve their process of investigating an unrecognized transaction, according to the research.

But digital receipts are not only useful for customers, they help merchants and banks too.

For merchants, digital receipts allow them to be paperless and save on post-purchase costs. 80% of merchants report that digital receipts lower the number of disputes and chargebacks.

For banks, digital receipts are a customer retention strategy. Currently, 50% of consumers across the world would consider switching their banking provider to manage their disputes better through their online banking app, according to Mastercard’s data. At a time when differentiation is becoming difficult, it is how banks empower their customers to act that makes all the difference.

Why subscription management tools in bank apps are powerful

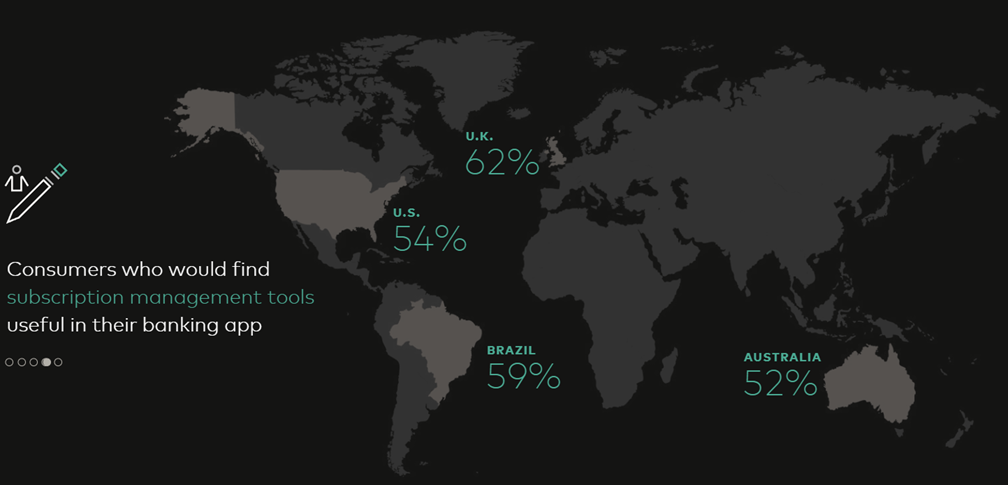

To enable consumers to act, banks and merchants need to identify which types of transactions contain the most friction for consumers. In payments, consumers feel the most powerless when it comes to managing subscriptions. 42% of customers forget that they are paying for subscriptions they don’t use and 50% of consumers in the US don’t cancel because the process is too difficult, according to Mastercard.

While paying for unused recurring subscriptions is frustrating and costly for consumers, it’s a missed opportunity for merchants and banks, too. And when customers aren’t clear on how to cancel or pause a subscription – it often leads them to file a chargeback with their bank, leading to increased fees and costs for merchants. Subscription-based business models always have churn, which means that merchants have to dedicate a considerable amount of time and resources to handle cancellations.

Businesses can save on these costs if they work with banks and move the subscription management process into the banking app. For banks, allowing customers to handle their subscriptions through their banking app adds value to their digital experiences. By failing to provide this tool, banks risk not meeting the demands of more than 50% or more consumers, who would prefer to manage their subscriptions payments in their banking app.

For merchants, the banking app can serve as a place to offer timely discounts if customers are planning on leaving and presents opportunities to upsell loyal customers on better subscription plans. And this strategy works: 30% or more customers have reconsidered canceling a subscription after receiving a discount.

Making subscriptions hard to cancel or relying on customers’ memory and ability to keep paper receipts are short-sighted strategies and out of touch with consumer expectations that are shaping today’s banking and retail industries. In a world with lots of options, merchants and FIs strike gold when they make a lasting impression, not when they complete a transaction.

For a deeper dive on this topic, download Mastercard’s most recent report by clicking here.