Big ideas help engage employees and keep the turnover numbers from getting bigger

- There are roughly 3 million more jobs than available people, a trend that started to come to a head after the pandemic. “We have a structural labor shortage out there,” said Jay Powell, Chairman of the Federal Reserve in 2022.

- One solution to this systemic problem is “Movement Thinking,” an approach championed by the transformation firm StrawberryFrog.

Today, the critical challenges facing employees at financial firms are systemic. Improvements, therefore, should also focus on systems — not individuals. “Systemic factors embedded in organizational cultures and processes are the primary cause of critical workplace issues — for example, leaders failing to execute strategy within organizations, threats to employee mental health and well-being, and a lack of belonging and inclusion,” according to a recent article in the Harvard Business Review.

One solution to this systemic problem is “Movement Thinking,” an approach championed by the expert marketing and transformation agency, StrawberryFrog and its innovation sister company, in plural.

There are roughly 3 million more jobs than available people, a trend that started to come to a head after the pandemic. “We have a structural labor shortage out there,” said Jay Powell, Chairman of the Federal Reserve in 2022.

At a time when it’s hard to find the right people, retaining employees has become even more important. At least a third of all employees are unfulfilled in their current positions and a similar amount are ambivalent about their job, according to a recent survey by StrawberryFrog.

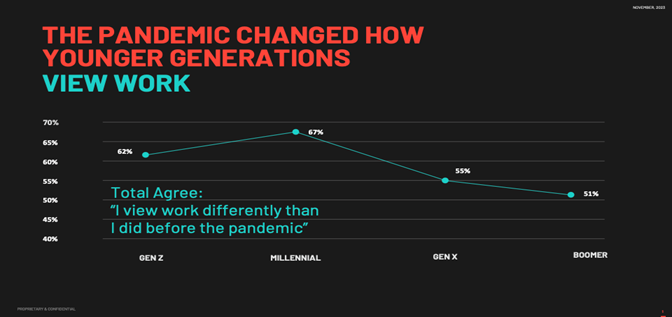

One big cause for this was COVID-19, which not only changed where employees worked but how they worked and the reasons why they worked. The virus revealed the fragility of our work. Since the pandemic, 74% of employees report that they have started to pay more attention to what really matters in life, and a similar percentage say they are rethinking their choices and how they spend their time. This value shift is most noticeable among younger employees.

As employees consider what to spend their time on, they are looking for employment to be more than just a means to an end. FIs helping their employees achieve goals outside of their daily 9-5 are able to foster deeper relationships in the workplace and can grow talent rather than being on an endless hunt for it.

For example, Desert Financial is a credit union based in Phoenix which offers its employees 100% tuition paid up front for skill-building courses and undergraduate degrees, as well as up to $10,500 tuition coverage per calendar year for graduate degrees or certificates. This allows the FI to coalesce work with career growth and can fuse the goals of the firm and those it employs.

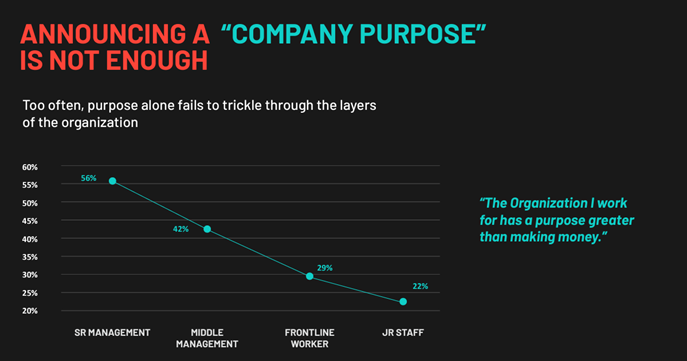

Similarly, relying on a paycheck and expecting a company’s purpose to resonate through the corporate chain of command to the most junior staff may no longer work. Data shows a thinning of conviction and belief in a company’s purpose the farther away you go from the C-suite. By the time you get to junior staff, just 22% believe that their employer has a purpose greater than making money, compared to 55% of managers further up the ranks.

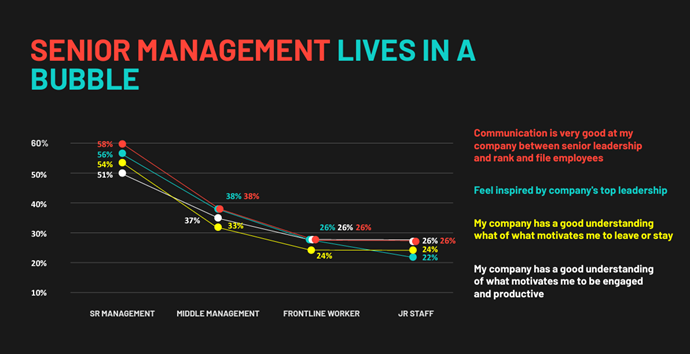

But this may be harder to see for those in charge because there is a gulf between senior management’s fulfillment levels and those working below them. While senior executives and managers report relative satisfaction, there is a steady decline in fulfillment and communication as seniority decreases.

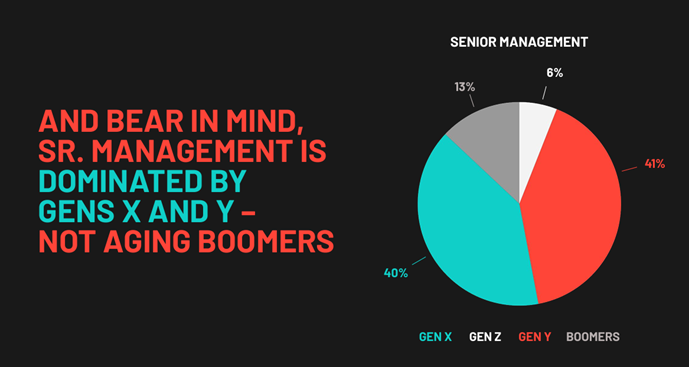

A big reason for this may also be the age gap and the attendant difference in mindset between those in senior management and junior roles.

Another employee-centric strategy can be retraining. Recently, Bank of America reported record low employee turnover of 6%, which was half the firm’s usual rate. Rather than dealing with the difficult labor market, Bank of America put in place a semi-hiring freeze last year and doubled down on retraining and reskilling employees it already had to fulfill its labor requirements.

There is also a side effect of the senior management bubble: Due to the lack of communication and silos between the senior management and junior employees, at any given time there can be two realities playing out in an organization. In one reality, the organization is responsive and available to its senior employees leading them to believe this is the case for everyone. And in the other reality, the corporate structure and hierarchies are distant and unaware of what junior employees hope to get out of their work. These two realities co-exist but are detrimental to employee retention and promote dissatisfaction.

Firms that focus on employee engagement are 23% more profitable. And despite pay increases in financial services, banks have continued to experience high turnover rates in non-officer roles.

One way to meet this head on may be to connect with employees by building what StrawberryFrog’s founder and CEO Scott Goodson calls movements, rather than company purpose statements, one-off campaigns, or team building exercises.

For example, Truist worked with the agency to create its onUp movement that rallied the firm’s employees, customers, and prospects to alleviate financial anxiety. The program focused on an 8-step financial literacy program and the firm experienced a 190% increase in employee satisfaction in the wake of the movement. At first the initiative focused on 30,000 of the bank’s employees but 6 years later it had expanded to customers and community members, reaching more than 7 million participants as the Truist was growing faster than it had before.

Even though the program started out as an internal project, the bank was eventually able to package it for other organizations like Delta Airlines and Home Depot. The bank also worked with StrawberryFrog to launch the Truist Cares initiative which married multiple campaigns together to support the needs of communities, clients, and teammates in response to the pandemic, even co-opting in high profile artists with messages of resiliency.

“It is a strategy developed by the leadership, which was about helping communities. And we activated that Truist Cares strategy in a number of campaigns. One of which has generated tremendous awareness and engagement is a program we did together with Amanda Gorman, who became the first US Youth Poet Laureate,” said Scott Goodson on a Tearsheet podcast.