The Customer Effect

Why Varo Money wants to become a full-service bank

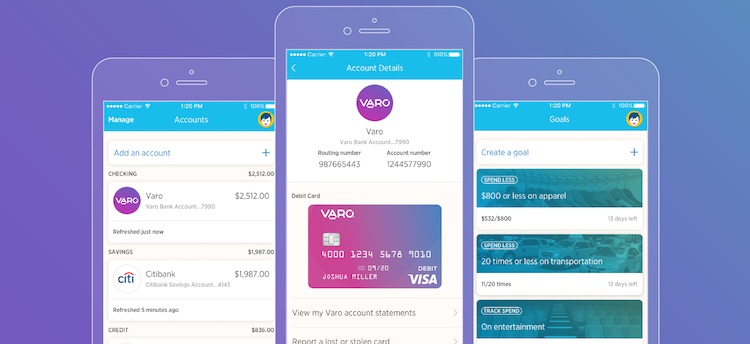

- Mobile banking startup Varo money recently applied for a banking license to broaden the range of services it offers.

- The move could help Varo generate additional revenue streams from deposits and lending products.