The Customer Effect

What Hurricane Matthew taught us about banks and fintechs

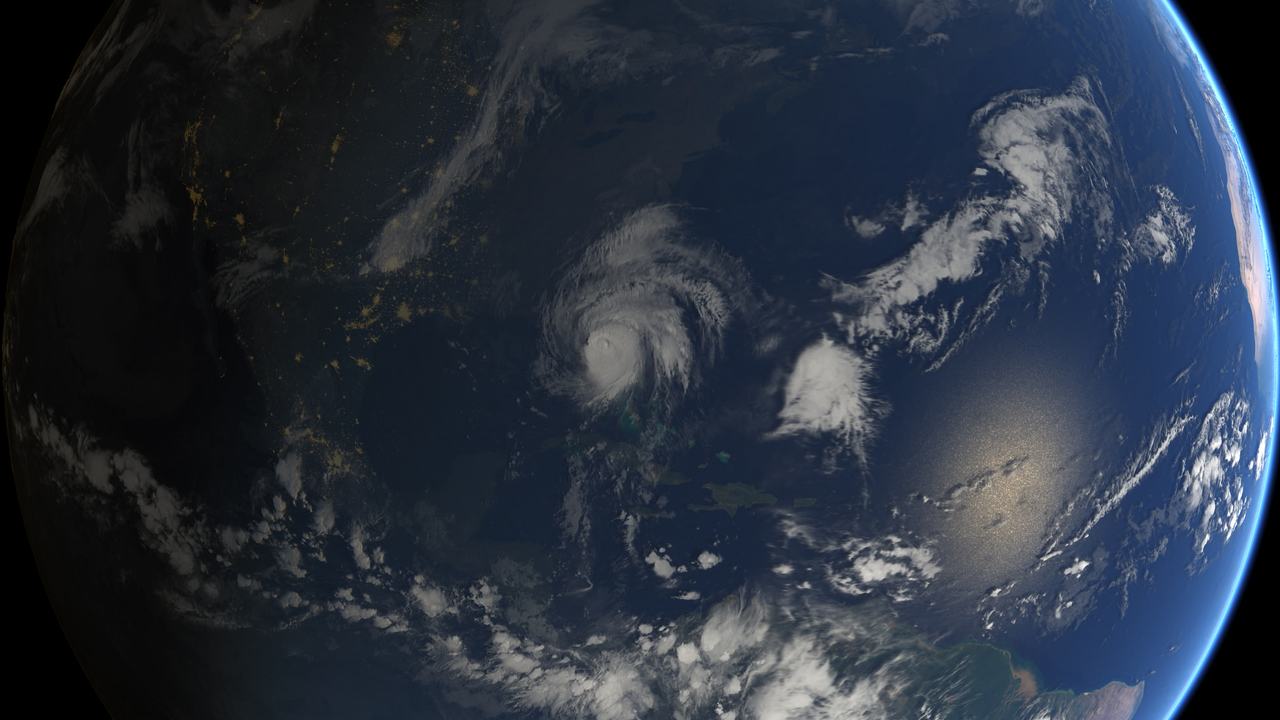

- Hurricane Matthew was the perfect storm to show how upstarts and incumbents differ when it comes to customer care.

- Unsurprisingly, the institutions that have been at the business longest came out ahead - by a long shot.