What financial goals are Americans prioritizing as they kick off 2024?

- Breaking from the norm, this year's resolutions prioritize financial goals over the usual focus on healthy eating and exercise.

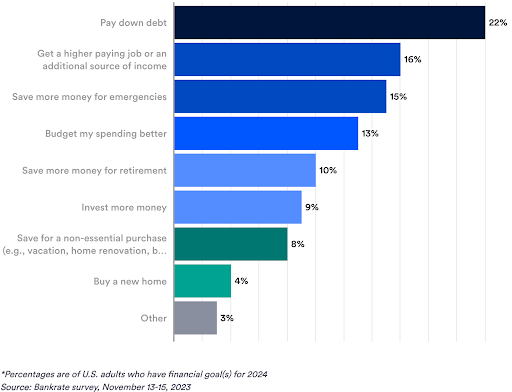

- While overcoming debt continues to be a primary focus of consumers, they are currently tackling the ongoing challenges of commencing the new year on more sound financial footing.

What financial goals are Americans prioritizing as they kick off 2024?

New Year’s resolutions are still a thing, and now they’re spilling over into people’s financial plans, too.

In contrast to previous years where promises to eat healthy, exercise, and shed pounds took center stage, this year sees financial goals vaulting ahead to become the most frequently mentioned resolution. The most common ones are minimizing debts and beefing up savings for a significant buy like a home, according to a recent Bankrate survey.

Despite Americans holding a positive financial outlook for 2024 at large, nearly half of them (46%) are inclined toward more frugal spending habits and the formulation of budgets in the new year.

While these goals already became a priority in 2023 for many, the sense of urgency around them kicks into high gear in 2024, driven by higher cost of living and soaring credit card debt and home equity lines of credit, coupled with the BNPL loans people took out during the recent holiday season.