The Customer Effect

Inside T. Rowe Price’s Facebook Live strategy

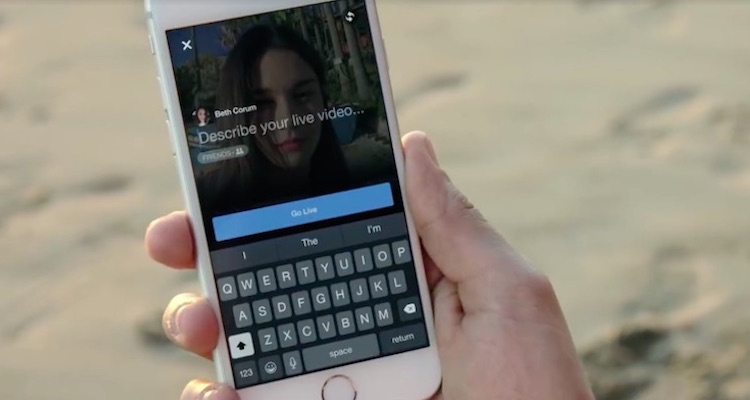

- Asset management Company T. Rowe Price has joined the line of brand marketers turning to Facebook Live to engage customers.

- While finance companies face some obstacles keeping Facebook Live content fresh and authentic, analysts expect its use as a marketing tool will increase due to its broad reach across demographic categories.