The Customer Effect

Inside Radius Bank’s virtual banking strategy

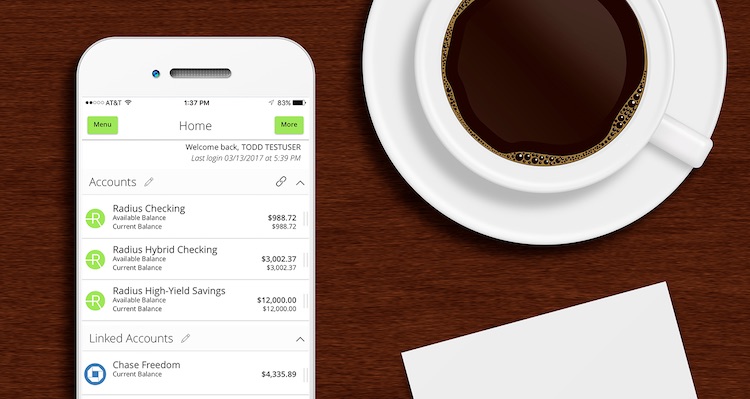

- Radius Bank, a Boston-based community bank, successfully grew its customer base through distinct product offerings and partnerships with financial technology companies.

- While the bank branch may be here to stay, the Radius Bank example shows that some customers may feel comfortable with a virtual bank if the products stand out from what incumbents offer.