The Customer Effect

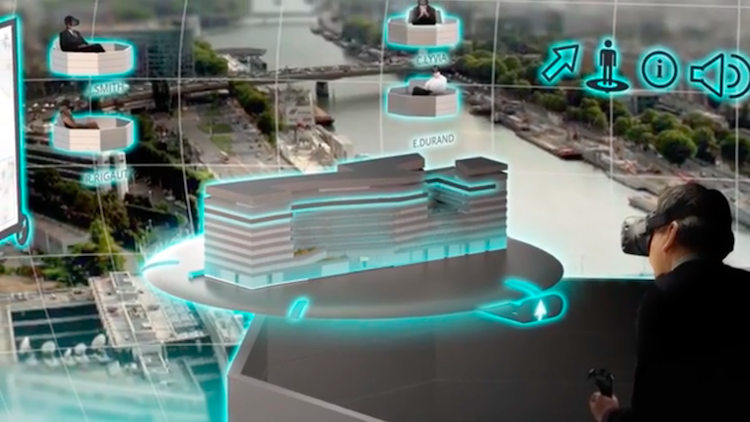

How banks are using virtual reality

- BNP has introduced virtual reality right into a mobile banking app

- Wells Fargo and Citibank are using VR in their marketing schemes, to develop customer relationships with their brands