The Customer Effect

Fake apologies, anti-artists, and elitist messaging: The year in financial services marketing fails

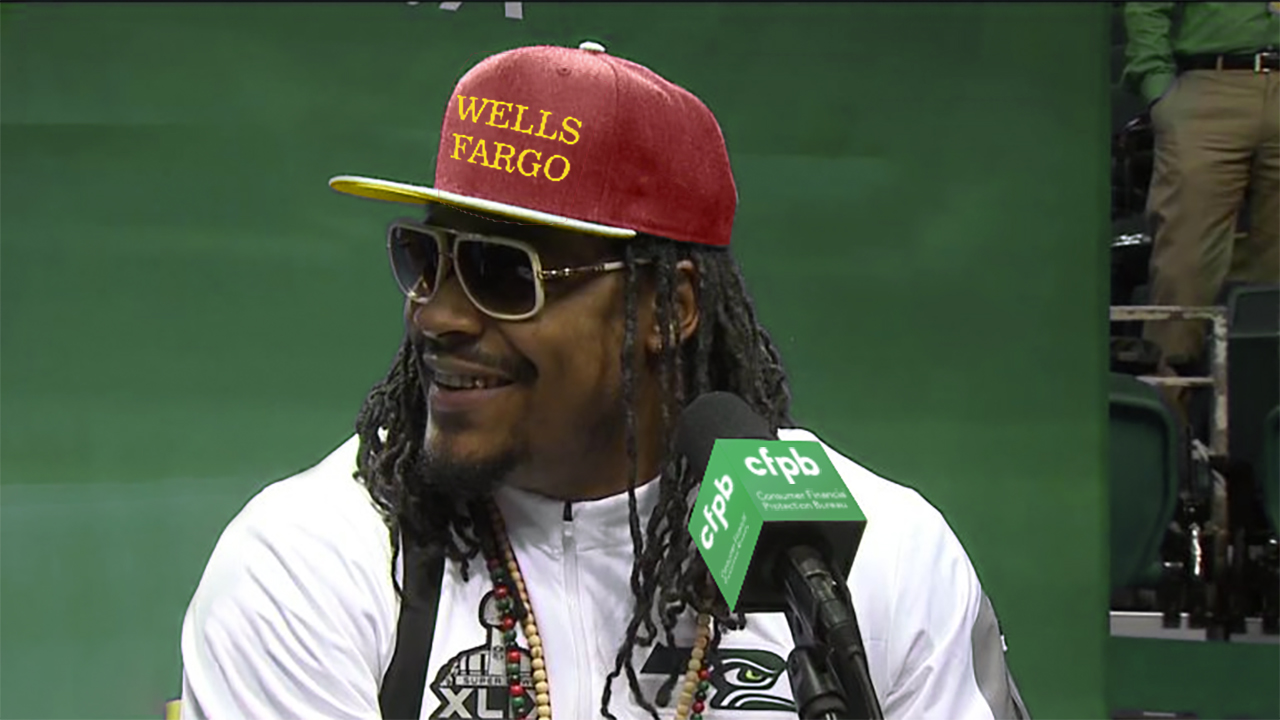

- Financial brands had their fair share of fails in 2016.

- Here's a list of the biggest marketing and brand gaffes during the year.