The Customer Effect

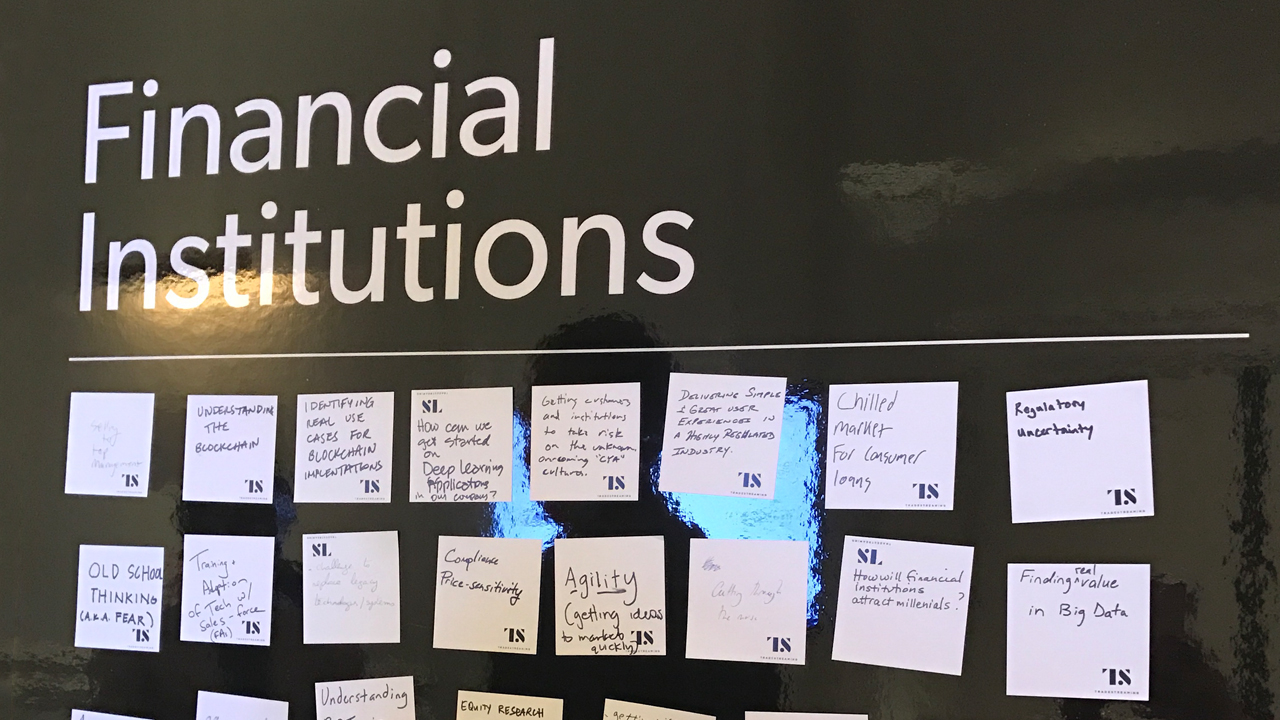

Challenge Board Confessions: Financial institutions get real about marketing challenges

- We asked participants at the Tradestreaming Money Conference to share their biggest difficulties.

- Innovation, marketing, and organizational friction all ranked high on the Tradestreaming Challenge Board.