Innovation

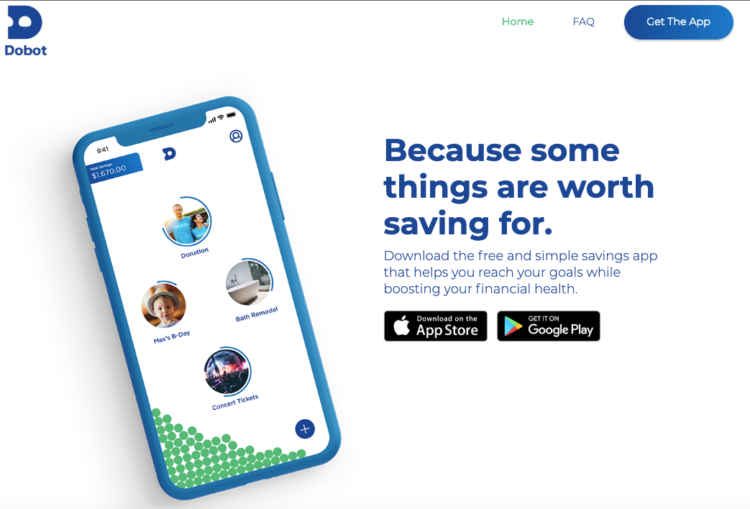

‘Couch to 5k for savings’: Why Fifth Third acquired personal finance app Dobot

- Fifth Third has invested and partnered with leading fintech firms.

- With the purchase of Dobot, it's the first time it went the acquisition route.