Future of Investing

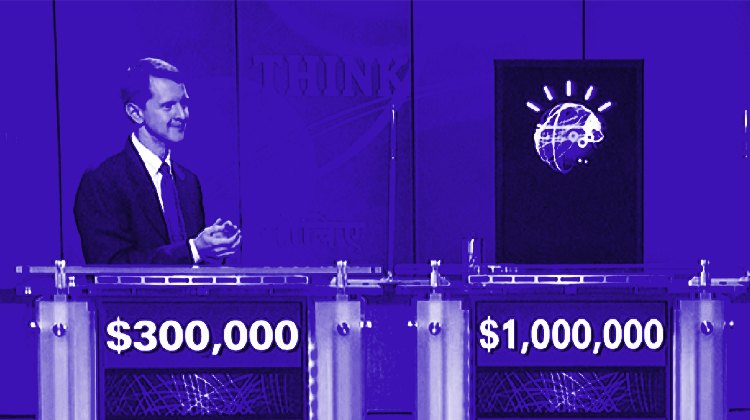

Surveillance technology enters wealth management with IBM’s Watson

- The upcoming DoL fiduciary rule is putting pressure on advisers to enhance their technology.

- Surveillance technology that ensures advisors are acting at their clients' best interests is emerging.