Future of Investing

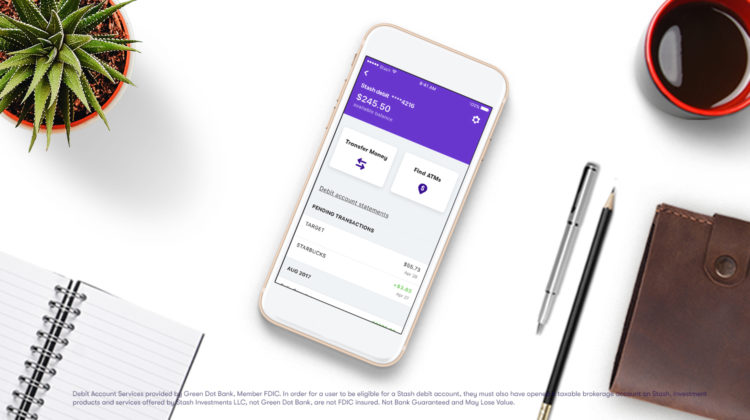

Stash rolls out new features, further blending lines between banking and investing

- Stash's popularity with users comes first from its savings features.

- By making it easier to save, Stash can deploy more client money into investments.