Future of Investing

Cheatsheet: What you need to know about fractional investing

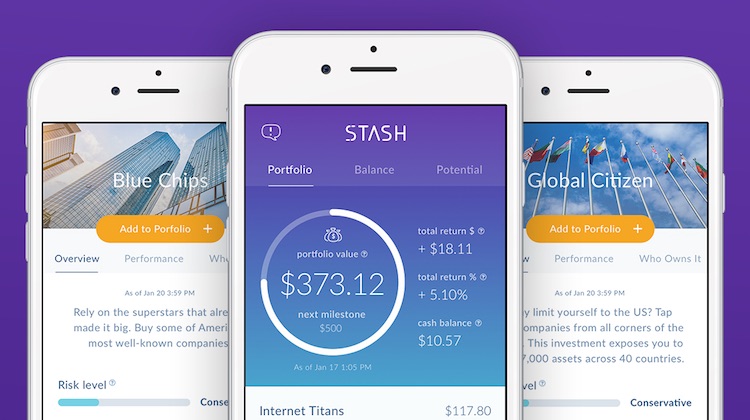

- Through the purchase of fractional shares, customers of modest means can invest in the stock market.

- Brokerages dealing in fractional shares say that while returns are important, financial education is a key objective.