As their popularity grows, more banks are eyeing gift cards as a loyalty perk

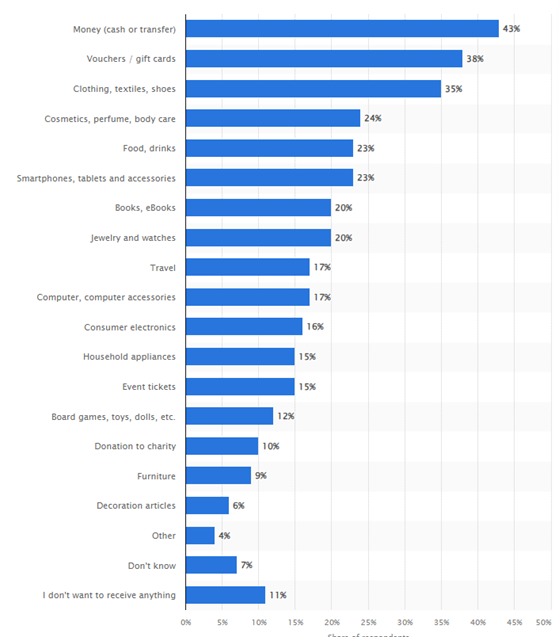

- Consumer interest in gift cards remains high, with 56% planning to purchase them for major life events and 38% preferring them as Christmas gifts over physical items.

- Given consumer interest, multiple FIs and fintechs are partnering with technology providers to offer gift cards and drive consumer loyalty and engagement.

56% of consumers plan to purchase a gift card for a major event this year, according to recent data. From weddings to anniversaries, major life events are the primary driver for this type of consumer purchase. In fact data shows that 38% of Americans would prefer to get gift cards and vouchers as gifts for Christmas, physical gifts (excluding money) are preferred less by 10 or more percentage points.

But even though gift cards aren’t new, how and where customers are buying these cards is changing. Urban dwellers are two times more likely to purchase a gift card through a P2P app like Venmo. Last year, the company announced a partnership with gift card manufacturer Hallmark, which enabled customers to gift money in a physical card by Hallmark. Venmo reports that 78% of its customers regularly use the P2P app to send money as a gift to their friends and family.

Along with the where, the what is changing as well, with 32% of customers reporting that they purchased an online gaming gift card. _____________________________________________________________________