Banking by Numbers: Chime launches a budgeting-based coloring book by partnering with influencers

- Chime is introducing an adult coloring book that can help consumers manage finances and make art at the same time, in partnership with two influencers and T-Pain.

- The coloring book aims to make managing finances fun and non-stressful and the amplification strategies around the book show how neobanks are reimagining consumer engagement while most traditional FIs are still struggling with getting consumers to read their education resources.

A big chunk of finance related content on TikTok focuses on financial literacy. Most of this content comes from individual influencers, not banks. But now neobank Chime has joined forces with TikTok influencer Allison Baggerly, who teaches budgeting techniques and methods on the platform.

While Baggerly’s techniques on the channel mostly focus on digital tools, like Excel, that can help customers budget, the partnership with Chime introduces an adult coloring book to consumers that can help them manage finances and make art at the same time.

The coloring book

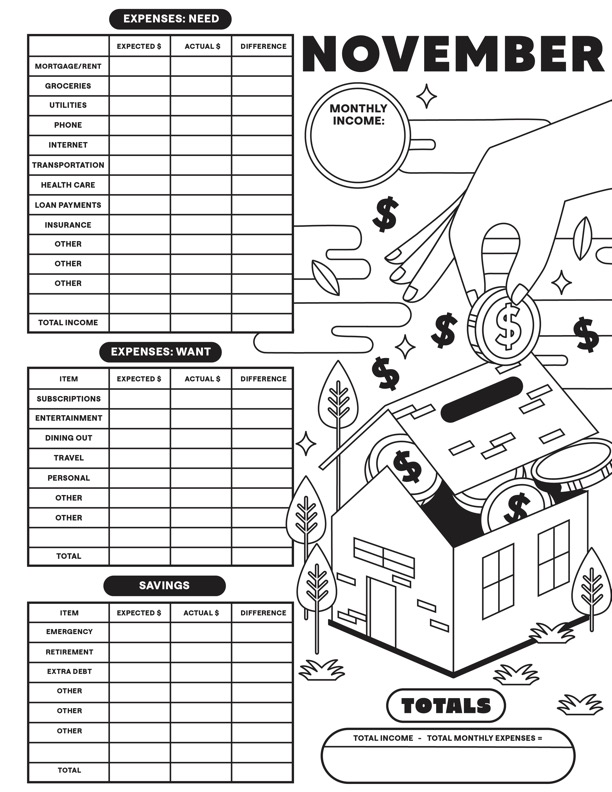

The 29 paged coloring book comes with a page for each month that has tables related to expenses and savings along with illustrations that consumers can color in while they budget. The book also has dedicated pages for consumers to draw what financial progress looks like to them and what they may be saving for.

The tables are designed by Baggerly who translated her teachings from TikTok into a written format that could help people get started on their financial well being journey. The illustrations for the book were done by Steffi Lynn Tsai whose “upbeat style” adds an overall air of “hope” to the book, according to the neobank.

“This process required me to think about budgeting in a completely different way! I love sharing tips for budgeting and managing money, but developing a budget in a coloring book meant I had to really think back to the basics of budgeting and how they could be translated into a physical book. It was a fun exercise to work with Steffi and Chime on creating a template that will actually work for basic budgeting, while encouraging creativity,” Baggerly told Tearsheet.