Built for success? A deeper look at why users are so excited about Bilt Rewards

- Bilt Rewards, a company that allows renters to earn rewards on their rent payments and neighborhood spend, has raised $200 million at a $3.1 billion valuation, led by venture capital firm General Catalyst.

- Dive into Bilt's business model and how the company started with an idea to make rent count towards ownership but then expanded to their current rewards-based model.

Bilt Rewards, a company that allows renters to earn rewards on their rent payments and neighborhood spend, has raised $200 million at a $3.1 billion valuation, with the round led by venture capital firm General Catalyst.

As part of its most recent funding, General Catalyst’s chairman and managing director, Ken Chenault will be joining Bilt Rewards board of directors. Roger Goodell, NFL Commissioner, is also joining the company’s board as an independent director.

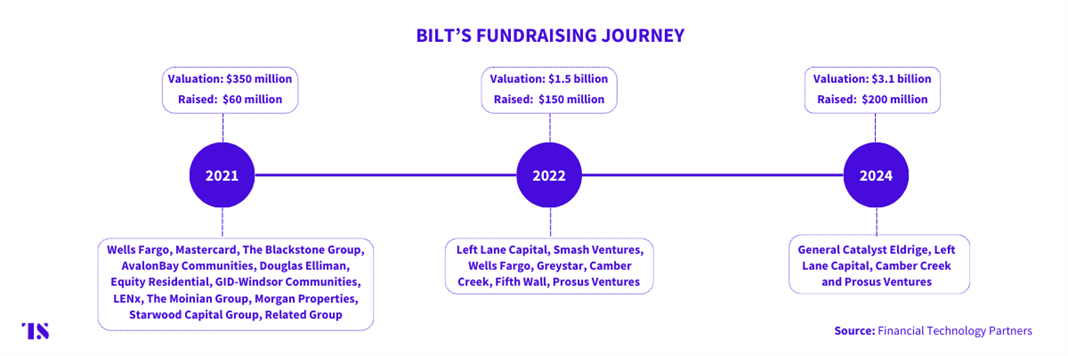

The company’s valuation has been rising steadily since it first raised money in 2021 at a valuation of $350 million in 2021. Over the years, Bilt’s financiers have included a mix of VC and financial services firms like Mastercard and Wells Fargo as well as real estate owners like the Blackstone Group.

What does Bilt do?