Data

‘We’re homing in on the underserved’: Intuit wants to lend small businesses money

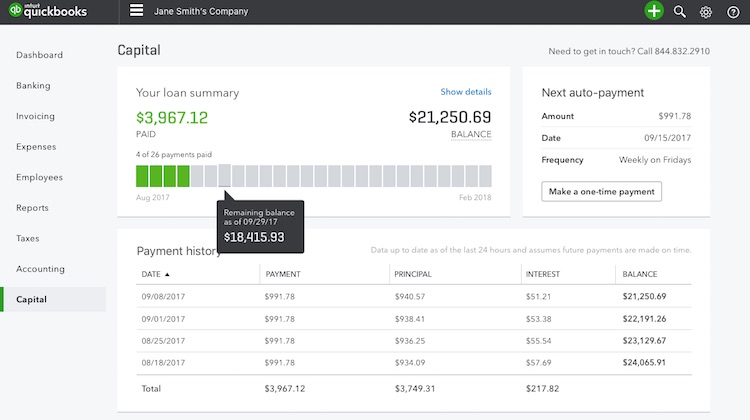

- Intuit launched a small-business lending product makes use of 26 billion billion data points within its QuickBooks platform.

- Intuit joins a league of fintech companies offering loans to small business owners who are underserved by larger banks.