Mastercard’s CTO of Operations answers what it means to be a CTO today in financial services and how to catch the right wave in tech

- Technology has become central to how financial services operate and this has put a spotlight on the role of the CTO.

- Dive into how Mastercard's CTO, Operations, George Maddaloni approaches building new tech and what impact does he think tech has on the organization.

The pandemic was a time of uncertainty and in those socially isolated days, one thing became clear: digital channels are important everywhere but most important, perhaps, in financial services.

The symbiosis between financial services and technology has cast a spotlight on the role of the CTO. While not the captain, the CTO is the shipwright, and as such, responsible for how the company performs.

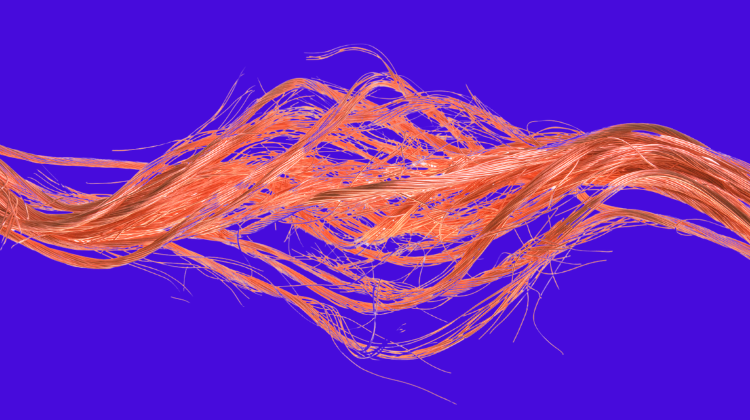

In fact, Mastercard’s CTO of Operations George Maddaloni thinks technology is to Mastercard, what the cardiovascular system is to humans.

“We’re powering the cardiovascular system of Mastercard. It helps connect the team, and so as a leader, when you can provide that mission to your team, it takes them to a little bit of a higher level, and gives them a perspective,” said Maddaloni.

Peering into the technological crystal ball

As a decision maker, it falls on Maddaloni to look beyond technological fads and be able to zoom into the future of an emerging technology. And technologies that can have a significant impact on how things are done today are emerging faster, Maddaloni says.

To describe this, he uses a surfing analogy:

“The waves that are coming ashore used to be a little bit more predictable and not as frequent. If you caught a good one, you were happy. But now they’re just coming faster and faster,” he said.

George Maddaloni, CTO, Operations, Mastercard

The tech playbook

As things get more unpredictable, Mastercard has a set of guidelines that informs how they approach new tech. Maddaloni and his team’s first job is to stay connected to consumer sentiment about new and existing tech and then think about their competition. “Of course, in our business there’s not just traditional competition, but disruption that you’ve got to be aware of, and you have to understand what’s happening there,” he said.

———————————————————————————————–