Blockchain and Crypto

Do we need blockchains to build digital identities?

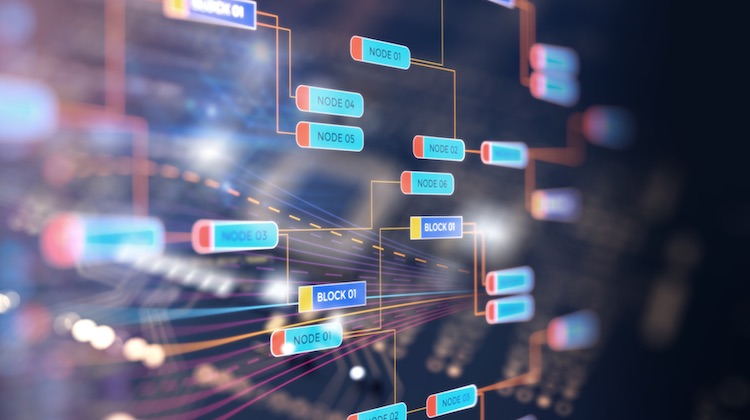

- Despite industry-wide excitement about blockchain as a solution to identity, blockchains solve a tech problem, whereas identity is a people problem

- Because blockchain technology removes the need for trust, providers of blockchain technology could be good partners for banks' identity solutions down the road