How Amex determines what makes or breaks a payment method and how it chooses the right payment tech

- From wearables to biometric payments, new methods constantly emerge but often face barriers to widespread adoption.

- This is how consumer expectations, merchant needs, trust, and tech impact adoption.

From the wearables hype to the in-car payments fad, the past few years have seen many payment methods rise and many fall.

The success of any specific payment method is strongly affected by macroeconomic factors, consumers’ perceptions, and technology. Take debit cards. Despite their first pilot coming out 1966, they didn’t become mainstays until the late 1990s and early 2000s. A big reason for this delay was that the debit card technology needed the ATM network to spread out and gain traction among consumers. In this way, both ATMs and debit cards rode the adoption wave together.

And when the right payment technology finds the right use case, the effects can multiply and impact societies. A great example of this comes from India, which used to rely primarily on cash up until recently, but a government-led push into digital payments is helping those who operated in the informal economy to build transactional histories and receive payments more securely.

Understanding barriers to adoption

Investigating what makes or breaks a payment technology can help us understand what future tech like CBDCs and still nascent tech like RTP needs to do to gain widespread traction.

Too many fish in the sea: Payments options have gone from being fairly limited to credit, debit, and contactless to suddenly ballooning to include wearables, QR codes, and in-car payments. “It’s a fragmented space – for changes to happen and be widely adopted, they need to happen across multiple layers of technology and industry providers,” says Matthew Robinson, EVP Payment Network and Acquirer Solutions at American Express.

Balancing online and offline modalities: New payment methods have to balance and support consumer behaviors in both online and offline environments, according to Robinson. Because customers can fuse both environments by starting a transaction online and then finishing it in a physical store, new payment methods either have to gel well with other payment options particular to an environment or be flexible enough to perform in both.

At the risk of the merchant: When evaluating a new payment method, merchants face a choice that has the power to impact their bottom line. “Merchants facing the various emerging payment options must make strong bets and the investment hurdle can be huge – both capital investment in equipment devices, but also in training and back-office functions,” Robinson said.

Research also shows that implementation costs play a very critical role in whether a payment method will reach ubiquity. If merchants perceive the cost of adoption as high, they eventually find ways to refuse a payment method, and transactions continue to happen using methodologies that are already in use.

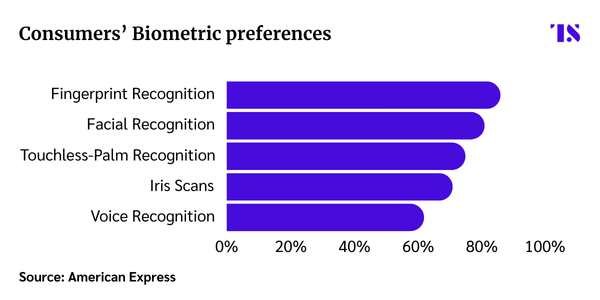

This issue is currently impacting biometric payments where 33% of merchants report expense as a deterrent to adoption, according to data.

Global interoperability: A payment method’s ubiquity depends heavily on how a particular method functions across markets. Debit and credit cards have this all figured out. But new payment methods face varying regulations and standards that may impact how well they travel. Recently, the industry was able to overcome this challenge for mobile wallets and contactless cards by standardizing the EMV Contactless Kernel and establishing a global standard for contactless payments across various devices and payment networks, said Robinson.

Establishing trust: Customers trust in the security and reliability of a payment directly impacts its likelihood of use, but establishing consumer trust is harder than it looks. Biometric payment methods have yet to convince customers that they are safe to use, with 39% of customers who report not wanting to use biometrics also reporting concerns about personal data collection.

How to encourage adoption

As payments technology evolves, it’s important for FIs, merchants, and fintechs to understand which payment methodology will be determining how consumers move their money.

The following factors can play a major role in driving adoption:

———————————————————————————————–

If you want to keep reading please consider becoming a TS Pro subscriber by clicking below.