CUs want a share of Tesla’s pie: Tesla and Origence partner up to offer EV financing at POS

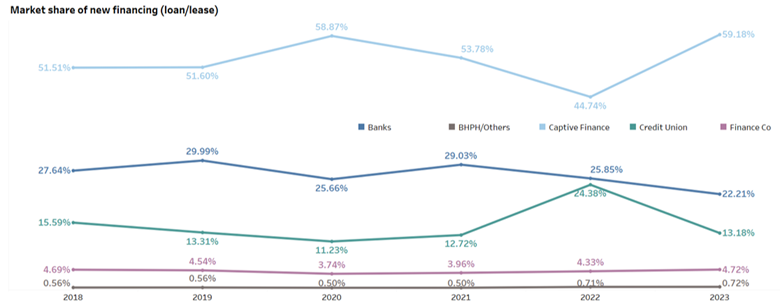

- For years, credit unions have been competing to increase their market share in auto financing. But last year, their market share fell for three quarters.

- For credit unions, EVs may present a possible solution to their market share problem.

For quite a few years, credit unions have been competing to increase their market share in auto financing. But last year some of that progress fell away as their market share fell for three quarters.

For credit unions, EVs may present a possible solution to their market share problem. Last year EV sales reached a record one million cars, although the number is not eye-popping on its own, especially considering that 15.5 million new cars were sold last year. It does represent the surge in demand for EVs which are expected to become 53% of all cars sold in the US by 2030.

Recently, Tesla partnered with Origence, a credit union lending technology provider, to help CUs offer EV financing through the Tesla website. The technology provider’s licensed subsidiary FI Connect allows customers to access financing at the point of sale.

According to Origence’s Chief Financial Officer, Neetu Bhagat this solves the issues of accessibility and affordability when it comes to financing.

“While EV financing at the point of sale, isn’t a new concept. Tesla has offered financing at the point of sale for quite some time. However, it hasn’t included credit unions as a financing option in their website until FI Connect. By offering FI Connect as a financing option, buyers can take advantage of competitive rates and terms available through credit unions right on the website – ultimately making their EV purchase more affordable,” she said.

Mechanics: Consumers in the market for a Tesla can shop and opt for credit union financing options on the manufacturer’s website. Their application is then routed to a credit union based on Tesla’s matching criteria. “When FI Connect is selected, we return decisions nearly 24×7. We automatically match the borrower to a credit union in our network and provide the membership agreement. Upon delivery of the vehicle, Tesla sends the e-signed package to FI Connect to purchase. We purchase the contract from Tesla, and then sell the loan with membership to the credit union on the same day,” Bhagat added.

If a customer is already a member of a participating CU, their loan is transferred to their own credit union.

For Origence and Tesla, the target market are consumers that have money to spare.

“Historically, the profile has been a super-prime borrower, with high net worth and discretionary income. They were rate sensitive and could often pay with cash. However, as EVs become more affordable, the addressable market continues to expand,” Bhagat added.

Being an active presence at the POS is expected to be increasingly important for CUs going forward, especially due to the competition in the market.

“In addition to retaining their own members that apply directly at the point-of-sale, our credit unions win high-quality new members as well. While we recognize that liquidity is tight for some credit unions, we see this as the right time to get in the game. As the market begins to rebound, it will be important for credit unions to be present and competitive,” she said.