UK-based payments processor, Worldpay floated its shares last week in the UK. Initially priced at a value of £4.8 billion, Worldpay is London’s largest IPO for 2015. This exit netted a reported £3.2B in profit for Worldpay investors, Advent International and Bain Capital.

Reactions to the Worldpay IPO

Reactions to the IPO have been generally positive in fintech land.

Bernard Lund thinks that the Worldpay IPO is a big deal for London:

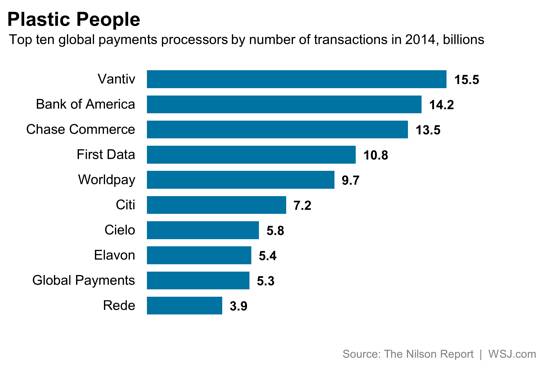

It is a big deal that Worldpay did its IPO before First Data – both are in payments and both were backed by US Private Equity. With a market cap of $20 billion, First Data is bigger than Worldpay (about #6 in the Daily Fintech Public Index), but we can now do valuation comparables across US and UK exchanges and I expect US and Asian investors interested in the payments space to be checking out Worldpay in London. Square IPO may struggle with these comparables.

Business Insider also thinks the Worldpay IPO is a pivotal moment for London fintech:

We could look back on Worldpay’s stock market listing in a few years and see it as the point fintech in London kicked up a gear. To have a £4.8 billion FTSE 100 goliath batting for the sector is huge.

Not everyone is so bullish on the Worldpay IPO. Some, like the WSJ, think the deal might have been expensive and perhaps auguring a bubble in fintech.

Investors in the IPO seem to be pricing Worldpay on profitability before the ongoing costs of building its own better systems, which it has been doing since being bought from RBS by private equity groups, Advent International and Bain Capital.

Strip these out and it still priced at 22-times underlying net profits forecast for 2016, or at an enterprise value that is 16 times underlying earnings before interest, tax, depreciation and amortization.

Some recent fintech companies that have IPOd, like Lending Club, have gone public with a lot of fanfare, only to see their share price flounder (Lending Club is down close to -40% from its IPO pricing). With Worldpay’s float and Square’s recent S-1 filing, public markets are certainly eyeing up fintech investments.

[x_share title=”Share this Post” facebook=”true” twitter=”true” linkedin=”true” email=”true”]

[x_author title=”About the Author”]