In today’s financial landscape, innovation is more than just a buzzword—it’s a driving force separating industry leaders from those left behind. Finding, nurturing, and scaling the right technologies has become a specialized skill set all its own.

Joining us today is Ryan Falvey, Co-Founder and Managing Partner of Restive. Ryan has spent the last 15 years at the forefront of identifying and championing market-changing innovations in financial technology. His track record speaks for itself—since 2015, he’s invested in 40 early-stage fintech firms that have collectively grown to represent approximately $3 billion in aggregate equity value.

Before founding Restive, Ryan led the development of the Financial Solutions Lab, a groundbreaking partnership between JPMorgan Chase and the Financial Health Network. His experience also includes developing payment solutions with leading tech companies at Silicon Valley Bank and serving as Strategy Group Lead at Enclude Solutions, where he oversaw global strategy consulting for mobile-enabled financial products.

“We’re not investing in fintech apps — we’re investing in infrastructure,” Falvey explains early on. That distinction underscores a larger trend he sees in the market: a move away from flashy consumer-based apps toward foundational financial APIs. It also focuses on backend tooling and embedded finance capabilities.

Falvey’s insights aren’t theoretical — they’re rooted in his day-to-day decisions as an investor. At Restive, he’s helping startups through early product development. He emphasizes practical scalability and regulation-ready business models. “You don’t build a consumer business by launching an app anymore,” he says. “It’s not about the app — it’s about access, context, and integration.”

From fintech regulation to platform economics, Falvey shares grounded wisdom. He focuses on how successful startups are navigating today’s uncertain investment landscape. What’s emerging is a more nuanced strategy for funding — one that prioritizes durability over disruption.

Listen to the episode

Subscribe: Apple Podcasts I SoundCloud I Spotify

Watch the full episode

The shift from consumer apps to infrastructure

According to Falvey, the biggest shift in fintech is where the value is being created. “The last wave of fintech was all about building shiny apps for consumers,” he says. “Now, it’s about making the systems that power those apps smarter, more scalable, and more secure.”

He points to the importance of financial APIs. He focuses on other backend solutions that serve as the connective tissue of modern financial services. These are often invisible to consumers. But they are essential for delivering the kind of embedded finance experiences users now expect. “The infrastructure layer is where the real innovation is happening. That’s where we’re seeing the biggest opportunities for venture capital.”

Reframing embedded finance as context, not channel

Falvey is careful to clarify what embedded finance means in practice. “It’s not just about plugging in a payment widget,” he notes. “It’s about being in the right place at the right time, with the right financial product — whether that’s credit, payments, or insurance.”

For him, embedded finance is less about technology and more about use cases. When startups can identify the consumer-based need and deliver financial functionality at the moment of need, that’s when embedded finance makes sense. Otherwise, it risks being just another buzzword.

The new venture capital playbook

“Startups are now being built in a different economic climate,” Falvey says. Gone are the days of massive burn rates and growth-at-all-costs thinking. In their place: a greater emphasis on operational discipline, regulatory readiness, and long-term scalability.

He explains how venture capital firms like Restive Ventures are adapting. “We spend more time with teams on product development than ever before. It’s not about speed to launch — it’s about building something that works, that scales, and that fits into the regulatory environment.”

Navigating fintech regulation and compliance

Compliance isn’t just a checkbox — it’s a design constraint. Falvey emphasizes that startups must build with fintech regulation in mind from the outset. “If you’re in fintech, you are in a regulated business. You can’t build first and figure it out later.”

He sees a growing appetite for products that are “compliance-first,” and that build regulatory considerations directly into their infrastructure.

The Big Ideas

- Infrastructure Is the New Frontier. “We’re not investing in fintech apps — we’re investing in infrastructure.”

- Apps Are No Longer the Centerpiece. “You don’t build a consumer business by launching an app anymore.”

- Embedded Finance Depends on Context. “It’s about being in the right place at the right time, with the right financial product.”

- Venture Capital Is Recalibrating. “We spend more time with teams on product development than ever before.”

- Compliance Must Be Baked In. “If you’re in fintech, you are in a regulated business.”

Read the transcript (TS Pro susbscribers)

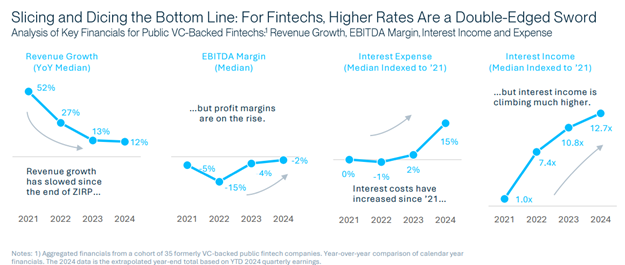

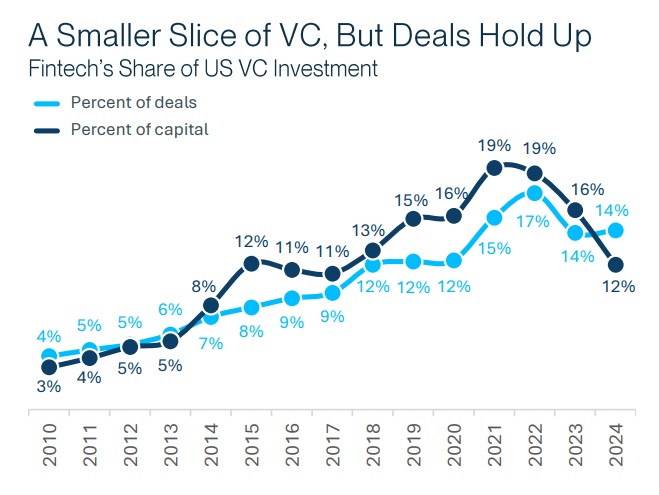

The evolution of fintech since 2021

Well, thanks for having me excited to be back. Maybe that’s a great way to start. I mean, that’s interesting, because we probably spoke at the absolute kind of high water mark of, you know, FinTech 2021, I was kind of the year. I remember, you know, you talked to other investors, and we’d like, man, we just should have done all the deals in the last like, shoot your fish in the barrel. Yeah. Any, any discrimination in selection was, was, was a, was a negative bias. And then, you know, things obviously changed really dramatically, starting in, starting kind of in 2022 and I think to a degree, continuing, kind of to the present day, really certainly been a shift in sentiment of fintech. More broadly. And then I think also, you know, kind of a shift in sentiment kind of increased a little bit away from tech too. So it definitely kind of feels more like kind of back to basics in what we’re investing in and how we’re working with the founders. But at the same time, I’ll say a lot of that. You know, we are investors in companies, and so the main thing we’re looking at is like, what’s the only performance of the companies? What are these businesses doing, and are they making money? And how much money are they making? And how fast is, how quickly are they growing? And what’s interesting and surprising is at the company level and at the portfolio level, it’s literally never been better. I mean, we already have companies that are growing much faster and making more money earlier in the life cycle than really ever in my investing career, going back into over a decade. Now,

Performance of recent investments

Yeah, do you mean honestly? I can tell you, I can tell you the date that things change, and it’s January 1, 2023 really? It’s really looking and I think it’s really the impact you had of a lot of these new kind of LLM models, AI driven tools, especially on the coding side, it’s just dramatically accelerated how quickly technical startups can develop product and iterate, try new things and kind of push, push their vision out in the world. And the faster you can move in a startup, the more things you can try, and the more, the more kind of shots on goal you have, and the more ways you can improve on a product once it starts working. And just to give you a snapshot, the investments we made since the beginning of 2023 now make more money into aggregate than everything we did in COVID combined. And there’s probably half the companies there, and the ones that are the ones that are the ones that are driving the revenue in that kind of COVID cohort are the most technical founders, like the strongest, you know, technology solution. And there we’re seeing a similar dynamic. There’s, they’re raising, you know, very little follow on capital. They’re running really lean teams, getting a profitability much earlier. And so it’s actually a really exciting time to be investing at the early stages, because we are, we are really seeing of COVID, the total phase shift in technology, and how these businesses are being built, and how big they can get.

Impact on exits

Yes, yeah. I mean, I think we’re already seeing, you know, it’s, yeah, I know when you’re going to air, air these this session, but, you know, it’s, it’s early April right now, and we’re seeing, you know, there’s a number of kind of FinTech companies that expect to go public here and in the next, you know, them kind of listed so far this year, yeah, the public fintechs have generally done, done relatively well over the last, you know, year and a half or so. So, I think there’s definitely a shift, kind of an appetite there in a late stage, and probably see more come. You know, the stuff that we’re investing in now. I mean this, many of these businesses are probably still five years away from from going public and you know you, we meet you, you tend to see mergers at this stage more and more frequent acquisitions. And I say that what we’ve seen on the acquisition front has been, has been pretty robust. But I think the best companies are probably not gonna be acquired. They’re gonna continue to try to grow. And I would, I would expect them to be, expect us to be seeing some, really significant businesses being built, kind of in this current era.

Thematic shifts in investment focus

I mean, we’re seeing a number of things. I mean, the big thing would be tech like, I can’t, like, you know, we’re investing in technology companies, okay? And that that is, and I think to a degree, you know, we, you know, we raise money ourselves, we explain to our investors, you know, we’re investing in technology companies who just happen to be in the financial services industry and and I think that that’s, that’s a real shift from 21 where, you know, people are like, Oh, we just needed digital. Stuff is going to take over, you know, so if it’s online, it’s going to be better than being offline. And you had just incredible growth of a lot of the businesses that existed and were doing which were strong, but it wasn’t like, hey, there’s a completely new technology here. And I think now we are seeing some truly new kind of technology innovations that are allowing founders to build entirely new, new approaches to financial services. And I’d say there’s kind of, there’s kind of, like six, kind of big categories where we’re seeing a lot of activity.

One is obviously generative, AI tools. The biggest impact there is actually probably within the startup, I’d say that, like, the best, best use case of AI is creating a company. Because, you know, if you have to create a bunch of stuff, you know, tools like, you know, chat, GPT and Claude and coding assistance like cursor, are incredibly helpful to create that stuff more quickly.

A lot of the crypto infrastructure that kind of got laid down over the last couple of cycles is now pretty useful, um, you know, there’s you there are there stuff out there that’s allowing for kind of agentic payments and ways of, kind of just automating kind of, you know, background, kind of purchase and inventory management systems that’s going to come directly out of, out of crypto. You have a company in a political Crossman that basically does that allows, you know, it was originally a lot of infrastructure for nfts, and is now being used to basically just kind of automate, you can automate payments, and, you know, just kind of set these kind of agentic payments to kind of run the background.

We’re seeing, I think the service industry, particularly around like consulting law firms, anyone who is making a lot of money by creating paper tax prep. I mean, those industries are under serious threat. And so we’re seeing startups there that are just, I growing at unbelievable rates, in large part because they’re just, they’re able to create advice layer. So, like in finance, about financial services, to say, like, you know that you have, you have services, and then you get a license from the government to do the finance part. And a lot of those services. You know, you’re you’re doing something that has an audience of one or an audience, maybe nobody. You’re just creating paperwork that sits on a shelf in case someone wants to see it in the future. I see you’re thinking about Iron Mountain. There’s a mountain just full of paperwork that somebody paper. Yeah, yeah. How much did all that paperwork has to get created? Like it was a lot. And if I can spin up it, like, you know, an AI engine that goes and generates that paper, and it takes five minutes instead of five months, that’s a huge cost savings. And there. A lot of parts of the financial service industry that just create paper. It might be you might might be support you need for a credit decision that you’re already going to do, but you need to go collect all that if you ever got apply for a mortgage. Great example, there was, like, tons and tons of paper associated with that. It’s all there for a reason. It’s all important in certain circumstances. It’s not necessarily all important to be done every single time by a human being. And so if you can find ways to kind of create, make, make that process automated, it’s really valuable.

You know, think about really expensive law firms that are reviewing a law firm might be reviewing multiple 100 page long documents associated with an extension of credit to a company, or the COVID signal back and forth. You know, a lot of that’s, you know, rope, boiler plate. It’s there for regulatory and legal reasons, and you’re still, every time you do all these deals, you’re spent, you might be paying millions of dollars to a fancy law firm to review all that we’re seeing that those types of the business can get start getting kind of get commoditized down very, very aggressively and very quickly.

Yeah, we’re seeing new technologies, like, kind of Horizon technologies are going a lot faster than you’ll be given credit for. Like, you know, there’s a lot of advances in quantum the first kind of uses of that will be in financial services, increasingly personalized and really intelligent ways of thinking about commerce. So we have a company a portfolio called aisle. Really interesting. They essentially connect brands directly to consumers. So instead of like you see an ad right now for, for, you know, Red Bull or something on online, online, and then maybe, maybe you go buy a Red Bull. And then, like, Red Bull kind of has to figure out, well, did the ad? Did it work, right? What happened here, attribution, models, all that stuff. Well, now this company allows Red Bull just, hey, go buy a Red Bull today, and we’ll just pay you back. And in exchange, like, the consumer gets a free Red Bull. That Red Bull gets to know exactly who the customer is, where they live, they shop. It’s like, acquiring a customer, post purchase in a way. And you know who they are. And very cool. That. So that’s, that’s a really good example of, you know, going to, kind of the future of commerce, where it becomes a lot more personalized, a lot more specific, and I think a lot a lot better, you know, kind of across the board.

The social impact of fintech

Certainly. I mean, I think you know when. So I, you know, I started my career. I started an accelerator that was backed by JPMorgan Chase in partnership with a nonprofit. And so we’re very focused on kind of, very consumer friendly financial services innovations. So we were investors in a company called dave.com which eventually has gotten now gone public and to help consumers avoid overdraft fees. You know, that’s probably on the podcast a few times. Yeah, that’s a really good example. I mean, I think we’re, you know that, like, as a public company, he had a, he had a little bit of a roller coaster ride. And, you know, over the last, I think last year was, like, the best performing stock, and like the net, like the Russell built a real business, yeah, and, and I think that that goes to show that, you know, if you dollar advances, right, yeah, yeah. If you have a, really, if you have an, if you have a, if you have a solution that really helps people, there’s, there’s a lot of, there’s a lot in that.

I mean, I think, I think it’s been, you haven’t heard as much about them, because I think the investor, investment community has gotten more concerned about, you know, kind of consumer businesses, large, I will tell you, as an investor in a number of these, because almost all these businesses are going to consumer facing, right, like you’re helping low income people or more moderate income people do something like, You need to acquire those people. You serve those people. There’s, there’s, there’s regulatory. Historically, there was regulatory kind of issues associated with, with, we’re serving those people. And so that was one category that was really kind of hit hard, kind of in that kind of post COVID, kind of, you know, FinTech, no crash again. Underlying company performance has been extremely strong. And, you know, Dave is a public company, and so anyone can see that, you know, that company grew throughout the last couple of years, it became profitable. As you said, you know, you kind of create a real business and that, and we’re seeing that kind of across the board. So I think investor sent them will probably catch up, and they’ll probably start hearing more about those types of solutions.

I’ll tell you that is one area where, where all of these generative AI. Tools are actually going to have a real big impact, I think, on customers. How so positive well we have so we have a company in the portfolio, small, small firm called charge back and basically look at your subscriptions that you rocket money has a similar solution with this too. They kind of look at your subscriptions, look for things that you can cancel, and kind of proactively go out there and try to save you money, cancels permission you might not be be using, and really just kind of low out there go looking for how to, how to, how to save, how to save consumers money. Well, they’re the ability to that, that that service, and I’m sure that with the team at at rocket has also made just dramatic improvements in what’s possible there, because I’m no longer just looking for, you know, Netflix to show up for, you know, 1399 every month. And these tools can go through and say, Okay, what? What it like, what are you actually using? Like, right? Like, I can connect your, you know, your browser history. Like, maybe you are getting a lot of value out of Netflix. Maybe there’s a service you signed up for that you really should cancel. Or maybe there’s a you bought something and you should have got a refund because they violated the terms of service and you didn’t know. And that is just that is a level of sophistication beyond where you saw before I saw I read something.

This is kind of off, you know, not, not really fintech. But I read something somewhere, some, some, you know, business, it was basically taking advantage of these individual arbitration clauses like forced arbitration. And everybody has been forced into, like, whenever you sign up or something, you basically agree to just binding arbitration. And the reason the companies do that is because, like, the most you’re gonna win is, like, $100 and I think this company was going, I basically, basically just doing this at like, mass scale. So like, instead of, like, you know, Disney video getting to fight you over $100 and you stop being worth it to you, like, they’re fighting 1000 fights for $100 across the country. And it’s just like, it’s more expensive than a loss it would have been. And so, like, that kind of stuff either requires a huge amount of technology to do that. But I think, I think you’re kind of going to see, see more of that in the coming years.

About Restive’s investment approach

Yeah, yeah. So we’re early stage technology investors. Our goal is to really be the first money into the companies and founders we back. So we like to say, you know, nothing’s too early for us. And you know, we are probably the first capital in the mains companies, and probably about a quarter to 30% of the time, and then, you know, the majority of the time, we’re going to be kind of pre seed investors. And so that might be a founder that’s raising, you know, let’s say one to $3 million probably, you know, pre might, might be pre product might be, you know, a couple months after rolling out a product. So probably, probably earlier than you assume, for kind of product market fit. But typically, we can get a sense of what they’re doing, understand what their vision is. And you might be a team of, you know, four, four or five people is kind of on average, and our strategy is to write relatively small initial checks. So our first check is about a half a million dollars into most these companies.

And then we work really closely with the founders to really help them to kind of to connect them to the broader financial services industry. So like I said, we’re looking for technology businesses just happen to touch the financial service ecosystem. So they might want to sell into them. They might want to manage, handle payments. They might want to, you know, access financial, financial data. And so we can bring a lot of expertise to the companies, and what we find is that can really be transformative to the best teams. And then we’ll look to really kind of dramatically build on our positions in these companies very quickly and grow and scale with them as they grow their businesses. So we’re pretty high frequency investors where, you know, we’re investing about once a month, we’ll find it. We’ll find a deal we like to do. And you know, like we at the outset, you think we were actually probably close to about 80 portfolio companies at this point. We’re now investing out of our third fund. And you know, we’re all, you know, former FinTech, you know, founders and operators, and so we really pride ourselves on being able to really try to become an extension of the management team and hopefully open up doors and kind of take things off the plate of the founders we’re working with, so that they can just move, move faster and grow more quickly.

Collaboration with founders

I think, I think most founders want help that’s helpful, right, right, like resistant against help that’s not helpful. We do try to be that help you with this podcast. You’re, like, probably not. You can sit there and like, you know, have a quiet room you can sit in. That would be the most helpful thing. Like, y’all need you with the dials and so.

We are, we are helpful in a really specific ways. We’re helpful in helping connect you the financial services you’re helping if you need to figure out, like a complex issue around your legal or regulatory dynamics, or you need expand your network to sell it or do more partnerships, if you’ve got a business that’s going to raise a lot of money, you know, our model is to connect our founders to downstream investors, and we spend a lot of time helping them build those relationships. And so if you know, for say, You got to bring it back to Jason today, if you know we’re one of the first investors in that company, help connect them to a series B investors, and we continue to be investors in that company now. And so we really see this as a really long term relationship. And, you know, try to be, try to be helpful in a way that’s, you know, going to be constructive to the relationship, and are going to get out of the way, or we’re not.

So we generally to that set. We generally aren’t taking board seats. As our view is, we’re really good at kind of pre seed and seed not super good at, like, series D, and like the decisions around going public, like, I don’t have great advice on who to your 18th engineering hire should be that, but there are investors who are really good at that, and those people should be on your board and and that. And you should the business should where it’s at in this life cycle. And so we are very focused on the part of the market we sit in. And I think we’re probably some of it, hopefully the most, most helpful investors to our founders at that category. And I what we found is, is most founders are quite appreciative of that, support. And, you know, they’re trying to build big businesses. And there’s a lot of talk of the Billion Dollar Startup of one person. I haven’t seen it yet. Yeah, we certainly have a number of billion dollar startups that have many people in them, and managing other people is hard and requires, you know, requires a lot of people helping, helping out to get there.

Geographic focus

Pretty heavy focus on the US. We have companies outside of the US market. But, you know, this is the market we know well, and you know, going to your earlier point. I mean, we stick to, we can what we know and where we think we can have a big impact. From an investment standpoint, this is also, like, the US financial services industry is maybe, maybe outside of, like, you know, big tech, the largest pool of revenue and profits in the global economy. And it’s a pretty dynamic one, where, you know, you have an interesting idea, you can very quickly get a lot of them. And so we think it’s a pretty good place to practice venture.

Evolution of partnerships with financial institutions

It’s gotten, I think, a lot more constructive for startups? Okay, great. I think it kind of to kind of two, two ways. One, there’s a, you know, I first started investing in 2014 2015 I was working, we very close to JP Morgan and very small startups. And I’d say it was a pretty common view that, well, we’re gonna, this will help us to partner with JP Morgan, and we’d have to be like, No, it’s not there. And that’s not the case anymore. I think there’s. There’s a lot of smaller financial institutions and banks in this country, across the board, and and also large FinTech companies that which has totally changed the dynamic of partnership. So if you’re just starting out, and maybe you’ve got it, maybe you’re a priest, you know, seed stage company, you’ve got a product in market, you can go and find like, stage appropriate partnerships, whether that’s an issue and maybe, maybe through handling payments. There’s, there’s banks that will do that if you’re looking to kind of, you know, sell into larger incumbents, or there’s kind of smaller, larger incumbents that will, that will buy the product and test it out.

And I think that the kind of that, let’s say that mid market category of financial services businesses that might do, you know, 50 to a couple 100 million dollars in revenue is they’re. Actually very smart now on technology. And there’s a whole more than I could that I know that would, that would be able, that would be excited to partner with startups, almost any stage, in any category. And then I think the larger financial institutions have also gotten very sophisticated, and for the most part, and how they engage with, kind of with startups, you know many of them, you know, many of the the venture capital programs, internal ones that they started, you know, maybe a decade ago now, are actually very sophisticated, really well run organizations that behave, you know, quite similar to VC funds. And so they’re looking for, they’re looking for investments that are going to make money for their companies, and also where there’s a strategic element.

But they’re, they’re, they’re much smarter. I don’t say that’s most that’s not the right way to any they’re, they’re just, they’ve come a lot more realistic on like, how this partnership can work, and like, with the constraints that that they like, the limits of how much a startup can affect their business, and how their own business could affect this. Affect a startup. And so I think it’s actually, again, going back to this has actually been a great couple of years in FinTech, because it’s a much more constructive environment for those partnerships, you know, like, or I can remember horror stories, you know, a decade ago where a startup would start working with a big financial institution and just get the Death Valley of meetings and pilots and all those kind of stuff, you just don’t see that as much anymore.