Two technologies have dominated the conversations in this industry for the last year: Open Banking and AI. Open Banking, because the 1033 rulemaking started a discussion on who owns the customers and their data, and AI, because, well, Gen AI.

Lets dive into how Open Banking and Gen AI impacted the industry in 2024 and how we think adoption is going to fare in 2025.

Looking back: Open Banking in 2024

The 1033 rulemaking, although contentious, is definitely pushing Open Banking from a possibility to an inevitability, and it’s a shift that is reflected globally. “Paired with innovations across the industry and regulatory advancements in different global markets have helped move Open Banking forward this year and will be instrumental to its sustained growth,” said Jess Turner, EVP, Global Head of Open Banking & API at Mastercard.

Banks’ strategies to Open Banking adoption and the 1033 rulemaking is primarily determined by their size, according to Ulrike Guigui, Managing Director at Deloitte, who says:

- Large banks and regional banks are building out the infrastructural and technological components needed for compliance and are also exploring use cases and opportunities.

- Medium-to-small sized banks are looking towards vendors to access the tech or are not prioritizing this topic in light of the lengthy timeframe to comply.

The infrastructure build that Open Banking requires can be a challenge for some banks: “For banks on their path to compliance with rule 1033, the challenge has been to put in place a cross-functional strategy that addresses the ‘builds’ that will be required: consumer portal, enhanced third party risk management and developer (API) portal. Mapping data from proprietary and vendor systems, putting in place the infrastructure to handle the anticipated volume of API calls as well as the operational capacity to handle increased consumer call volume, are time consuming tasks in an environment of stretched resources,” said Guigui.

With banks finding that they may soon need to act on Open Banking either due to competition or regulation there is also a push towards raising the overall industry standard. Mastercard’s Turner adds that she has observed a call to make the ecosystem more secure as well as an added emphasis on ensuring that consumers are at the center and have control of their data.

Trends: Open Banking in 2025

As the industry navigates the infrastructural challenges and the changing regulatory landscape, we can expect to see the following trends emerge: i) More financial inclusion for consumers: Traditional credit decisioning systems may be excluding a significant portion of customers from accessing liquidity and credit. But Open Banking may be able to bring more customers into the fold. “Open banking’s innovative use of alternative data – for example, using data like rent payment history, cash flow and balance analytics to prove creditworthiness – create more opportunities for those outside of the credit mainstream to take control of their financial lives,” said Turner. This is not necessarily a new use case but the regulation-driven adoption of Open Banking and the formalization it is making necessary may finally push alternative data usage from being on the periphery to being more widely deployed.

ii) More business for vendors: Technology providers and vendors play a huge role in helping this industry shift towards new technologies, and while Open Banking isn’t ground breakingly new at this point, the number of vendors that offer these capabilities isn’t too large. “With the final passage of the rule and revised timelines, industry participants now know they need to prioritize this broad implementation and there may well be excessive demand on the few vendors who are active in Open Banking,” said Guigui.

iii) Products and experiences: Deloitte’s Guigui expects to see product development to be focused in CX and building operational efficiencies.

- Customer experience: Existing customer-facing processes like account opening and underwriting may become easier due to better availability of data.

- Operational efficiency: Banks might be able to utilize the increased availability of data to improve anti-fraud measures. There will be opportunities for banks to leverage data to improve fraud and related back-office activities.

Looking back: Gen AI in 2024

Last year, the industry warmed up further to Gen AI. It was a welcome shift from discussing whether Gen AI could end the world towards discussing what it could do for us and how to ensure it does everything safely.

Big banks like JPMC, Morgan Stanley, and Truist all found back office tasks that could benefit from the tech. Some small but forward thinking banks are realizing that building AI literacy and capabilities in their workforce is essential and launching strategies that help their workforce upskill. Meanwhile, fintechs like Public and Lili continued to move faster and found ways to augment their customer-facing interfaces with Gen AI-powered digital assistants.

“2023 was all about education and doing proofs of concept, while 2024 was about leveraging those learnings to build enterprise AI platforms and beginning to move GenAI use cases into production. At the end of 2024, we have seen solid progress from financial institutions using Gen AI in their organizations and expect this to continue to ramp up in 2025. These use cases have been focused on efficiency plays and supporting workforce acceleration but have included a human in the loop,” said Kevin Laughridge, Principal at Deloitte.

Trends: Gen AI in 2025

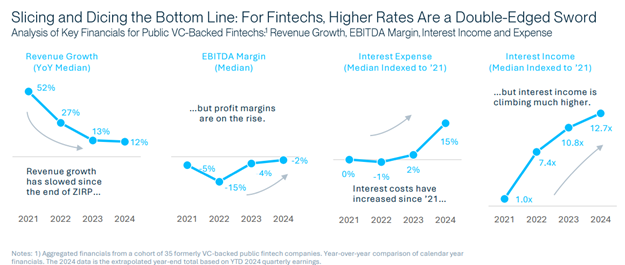

So far, firms (specially banks) have used Gen AI to make their existing processes more effective. But as ease with the technology increases it’s likely that Gen AI would start to feature more heavily in products and impact firms’ bottom lines.

i) Pushing into the front office: Even though there are very few active projects that hint at banks implementing Gen AI in the front of the office, it’s unlikely that it will always be this way. It took banks years to act on chatbots but they did eventually. The natural evolution of the chatbot is enhancement through Gen AI. Similarly, as comfort levels with the technology increase driven by the formulation of internal governance policies, moving implementation to the front of the office will become less daunting.

“We expect to see the GenAI use cases in financial services begin to move from the middle and back office to supporting more front office functions and move to support more revenue generations vs. driving efficiencies,” said Laughridge.

ii) Open Banking + Gen AI: There is also a possibility that both Open Banking and Gen AI technologies will come together to enhance already existing products like PFMs – layering on top of one another to enhance product experiences through automation. “In synergy with informed consent protocols, open banking data, coupled with responsible Generative AI, can optimize a consumer’s financial management, essentially acting as a personal wealth manager,” said Mastercard’s Turner.

iii) Infrastructure builds: FIs hoping to take better advantage of innovations offered by Gen AI will need to invest in improving their technology and make bigger strides in their data modernization journey. “Financial institutions will need to galvanize their AI platform; this is more than simply picking an LLM, it is a platform that enables scaled AI with many LLMs in a controlled environment,” he added. iv) Managing people: As firms continue to deploy Gen AI first in the back office they will need to make a concerted effort to ensure their employees not only possess the technical skills to leverage Gen AI, but the data literacy to understand its risks. “FIs will also need to work through change management of their employees, continuing to show why AI is a workforce accelerator and enabler of business value,” he said.

Sidebar: Banks’ barrage-like movement when it comes to Gen AI