From ‘BaaS is dead’ to discussing how Gen AI and Open Banking could significantly change how fintechs connect to banks, serve customers, and help push the industry forward, 2024 has been a really happening year for fintechs.

In this new year we look at how fintechs fared in 2024 and explore what shifts we can expect from these companies in this new year.

Victoria Zuo, Principal at QED investors, says after a few years of headwinds she expects 2025 to be a year of recovery.

The turnaround for fintechs was most evident in the uptick in public markets. It restored confidence in fintech companies following successful IPOs, according to Zuo. On the other hand, the private market continued to cherry-pick fintechs that exhibited they had what it takes to reach profitability, she added.

Most importantly, in this year of many changes, fintechs had to find a way to pivot away from ‘growth at all costs’ and towards efficient scaling and operational discipline.

“The year showcased the resilience of the sector as it adapted to macroeconomic challenges and recalibrated for long-term success,” Zuo added.

Looking back: The trials of 2024

Last year came with challenges that destabilized assumptions about what it takes to build fintechs, run them, drive them to success:

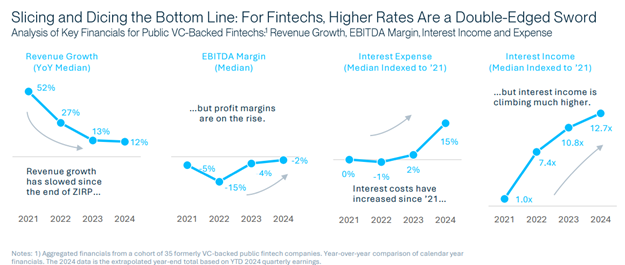

a) The interest rates paradox: At the start of 2024, interest rates remained high and the uncertainty surrounding cuts continued to challenge fintech leaders to think on their feet about how their firms will make money. “Rising rates squeezed margins for lending-focused fintechs, forcing them to diversify revenue streams and focus on underwriting excellence,” said Zuo.

Research by SVB backs this up, showing that fintechs have had to focus on acquiring high quality borrowers instead of extending credit to borrowers that may carry revolving balances. But as a result of this strategy, fintechs have had to reap their profits from interchange fees.

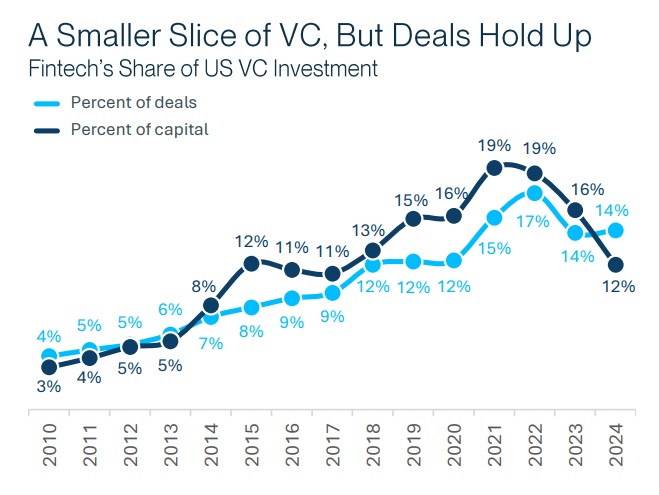

Elusive funding: Fintech leaders had a hard time chasing VC dollars in 2024, pushing them to focus on their business models. “Access to venture capital remained limited, prompting startups to extend their runways through cost optimization and prioritizing monetization over growth,” she said.

The looming regulator: In 2024, regulators started to contract the freedom the industry had available to innovate and pushed its leaders towards building more safeguards and guardrails. This was most evident in how fintech-bank partnerships became strained due to a towering amount of consent orders for bank partners. “The regulatory landscape, especially in areas like BNPL and crypto, grew more stringent, pushing fintechs to invest in compliance and risk management,” Zuo added.

Capitol Hill in flux: 2024 was an election year and the fintech industry was no stranger to this. FIntech leaders were caught in between red and blue, as questions about the Biden administration taking a more pro-regulation stance through government bodies like the CFPB clashed with ideas how a Trump administration could shift this focus.

“A new administration could bring a more business-friendly approach, particularly in areas like crypto, financial inclusion, and open banking,” said Zuo.

The regulatory push didn’t just impact how fintechs chose partners and structured products but also impacted their bottom lines.

“Compliance costs have risen due to rising regulatory pressure, especially regarding BaaS partnerships. Fintechs are now responsible for more compliance requirements, leading to higher operational costs and a greater focus on regulatory diligence,” said SVB’s Head of National Fintech and Specialty Finance, Nick Christian.

But Zuo feels that moving ahead, this focus on building a strong compliance-forward foundation could be beneficial for the sector, saying that the stricter regulatory environment served as a “forcing function for fintechs to strengthen compliance” and will help in building consumer trust and robustness in the system in the long term.

The making of a hero: The fintechs that rose up from these challenges were focused on improving cash flows, lengthening their runways, and had an eye on customer pain points, as well as regulation shifts.

_____________________________________________________________________