Quarterly statements from investment managers will never will a Pulitzer. These documents, at best, aren’t user friendly and at worst, entirely opaque. It’s hard for investors to make sense of what their real performance was. And that’s just looking in the rear view mirror. Harder still is understanding how your current mix of investments and allocations across sectors and geographies should perform into the future.

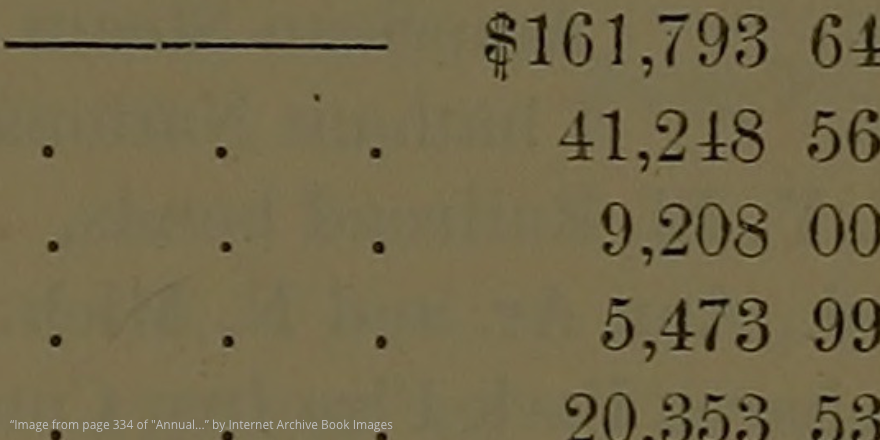

The above is just a typical bad example of an investment statement. This statement, by the way, was used during the Madoff trial and was almost completely fabricated. The problem with most investment statements, unlike this one, isn’t their veracity — it’s that the data isn’t presented in a way that

- investors can understand how well/poor they did over the time reflected

- investors can understand how their current positions may perform over the next time period

To be honest, displaying investor performance isn’t trivial. Money is continuously moving in and out of accounts, dividends and interest accrued, rebalancing changes allocations. Unfortunately for investors, though, there hasn’t been a whole lot of reason for investment firms to invest in making their statement and portfolio tools more user-friendly.

Enter the portfolio trackers.

Portfolio trackers help investors make sense of what they own

Around 2011, just a couple of years after the worst financial crisis since the Depression, fintech entrepreneurs sensed there was an opportunity for digital disruption. The stock market suffered huge losses and investors were left with a sense of despondency — they owned low cost mutual funds or ETFs, they were diversified, they were passively indexed. So, how come they suffered such losses?

Since asset managers and brokers weren’t incentivized to help their clients make more sense out of their holdings (especially, since most investors have investment holdings across various firms), fintech startups were founded to take advantage of this opportunity.

Companies like Personal Capital, SigFig, and Jemstep were founded as portfolio trackers, providing a better and more understandable spin on investor portfolio and performance.

In fact, the first portfolio tracker to gain traction was Cake Financial, which sold to ETrade in 2010. Cake was a novel offering — it allowed investors to hook up their various investment accounts and gave better views into how to look at investment performance. Because Cake was used by a community of different investors, Cake also baked in some decision making tools into its platform — giving users suggestions as to best practice and portfolio composition of other investors in their same geography or sharing the same investment style.

Portfolio trackers fill a void left by asset managers and brokers. Few firms offer investors portfolio analytics and reporting that take into account assets held outside of the firm. Portfolio trackers are agnostic to where the assets are held and in turn, give users a more complete view of their finances.

Portfolio trackers, created by fintech entrepreneurs freed of certain constraints of the investment industry, can provide more instructional views into performance. Because they sit on top of brokerage and investment firm data, there’s no need to whitewash or protect the story behind the performance.

Beyond analytics, portfolio trackers try to help with investment decisions

Portfolio trackers provide views into historical performance so that users can better understand how their investment money is doing. But modern trackers attempt to take this a step further by offering decision making tools.

Portfolio trackers make automated suggestions at the individual security level and at the portfolio level. Thes new tools can identify underperforming assets or expensive funds in a user’s portfolio and make gentle suggestions to users to consider swapping out an individual security. At the portfolio level, a portfolio tracker can benchmark a user’s portfolio against a model portfolio that better represents the user’s risk tolerance and investment horizon. If there’s a discrepancy, portfolio trackers recommend making asset allocation adjustments.

All this is done by computer algorithms. There’s no investment advisor sitting in front of the user or on the phone making investment recommendations. The portfolio trackers don’t care if I’m a college student, a millionaire, or a billionaire — the recommendation engines are programmatic. There’s no ego involved, just complicated portfolio composition to best match historical, present, and future outcomes.

How portfolio trackers make money

One of the most exciting advances in modern portfolio tracking technology is that startups in the space were giving their tools away. You could sign up for Personal Capital’s portfolio tracker and it wouldn’t cost a thing. Most portfolio trackers’ business models entailed giving the tracker away for free and attempting to monetize the user in a different way.

There are a couple revenue models at play here:

- Give the tracker away to attract assets: This was Personal Capital’s objective from the start. Give away the portfolio tracker to whomever wants it. Let the user get comfortable with this automated approach to analytics and reporting and when the prospect is ready to have Personal Capital manage his or her portfolio, it just took a couple of clicks (the portfolio trackers are already have access and are monitoring user investment accounts) to start an account transfer process. Personal Capital then charges a (small) fee based on a client’s assets transferred to the firm. SigFig, as you’ll read below, began with a different model but has migrated towards monetizing its portfolio tracker by moving into investment advisory work. Instead of an AUM (assets under management) fee, SigFig now charges an fee on AUM.

- Give the tracker away and monetize referrals: SigFig began with this revenue model (and recently switched to charging a subscription fee). In return for using SigFig’s powerful portfolio tracker and recommendation engine, users would receive offers for complementary services and products. For example, SigFig could tell me a user that the fees she pays her Merrill Lynch broker are in the top decile of all Merrill Lynch clients using SigFig (SigFig knows this information because it’s tracking billions of dollars in thousands of accounts). With that information in hand, SigFig would offer a user a meeting with another asset manager that fits her investment style that may be a lot cheaper. This online financial services referral model was made famous by Mint.com, the famous personal finance app that helped users track their finances and made money by offering financial products. Credit Karma is doing the same on a larger scale now.

- Provide these tools institutionally: Jemstep has kind of pivoted away from targeting individuals and has instead focused on providing portfolio tracking tools to institutional asset managers.With Jemstep, investment advisors have a platform to automate client engagement via digital tools. Jemstep enables investment firms to “program” its advisory platform with its own asset allocation recommendation and portfolio models. In this sense, some of the portfolio trackers look more like roboadvisors than just technology players at this point.

- Charge outright for the tools: Morningstar falls into this category. The famous investment data and analysis company provides some free portfolio tracking tools but the jewel in its crown is the Portfolio X-Ray, which uses the firm’s 9-point analysis. Access to Portfolio X-Ray comes with a paid subscription to the firm’s premium product (about $200/year). It’s generally hard to get individuals to pay for portfolio tracking tools, which is why today’s startups in the space have gravitated to other revenue models.

What are the leading portfolio trackers?

- SigFig: SigFig began its life as Wikinvest, a wiki for younger, savvy investors to collaboratively research individual companies and sectors. After pivoting towards SigFig, the company turned its focus on providing an automated portfolio tracker through partnerships with leading media companies like CNN and USA Today, which offered SigFig’s tools as their website’s core portfolio tracking tools. According to CrunchBase, in 2013, Sigfig raised $15 million from investors like Union Square Capital and Bain.

- Personal Capital: Personal Capital was founded by well-known fintech entrepreneurs who have lead other innovative companies in the field of finance, like PayPal, Intuit, and EverBank. The company has raised over $100 million from leading venture capitalists and tracks $175 billion of portfolio assets for 850,000 users of its portfolio tracking tools.

- Jemstep: Jemstep has raised $15 million in investments to build out its digital portfolio tools. While in recent months, it’s moved away from marketing its portfolio tracker directly in lieu of working with professional advisors, you can still find access to using its consumer portfolio tracking tools.

- Morningstar: The well-regarded investment data and tools company has its own portfolio trackers that are well-regarded in investment circles. There’s a free instant x-ray portfolio tracker and a more in-depth premium version which analyzes portfolio according to Morningstar’s 9-point system. That comes part of a yearly membership that costs close to $200.

Portfolio trackers have been a boon for individual investors, helping them visualize past performance and plan for the future for all their assets, regardless of where they’re custodied. It’s hard to monetize a portfolio tracker, so many of the companies who produced the best products are creating larger financial companies of which the tracker is just one piece. As individuals demand more from their investment managers, it’s clear that portfolio analytics and reporting and communications will improve over time.

[x_share title=”Share this Post” facebook=”true” twitter=”true” linkedin=”true” email=”true”]

[x_author title=”About the Author”]

:::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::

:::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::