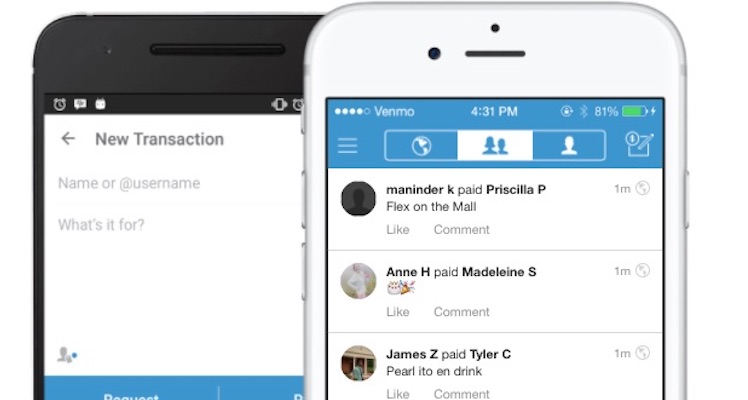

Venmo rising: Why PayPal wants you to pay for purchases using the app

Hardly a Venmo killer, banks are being cautious with Zelle rollout

[interview] Paying for the insurance we actually need via a peer-to-peer model

Tradestreaming had the opportunity to chat about the future of insurance with Tim Kunde. He’s co-founder and managing director of Berlin-based friendsurance, a company taking aim at disrupting the insurance industry. It’s doing so by changing the way we purchase and subsequently, behave with insurance coverage.

Tim graduated with a Masters in International Management. He started his career with The Boston Consulting Group, advising various companies on consumer goods and insurance matters. He is responsible for marketing, business development, sales, IT, product, customer support and CRM.

[x_line]

What was wrong with the way traditional insurance worked? Why do you think it was expensive and opaque?

In 2010, the founders of Friendsurance realized that many people own insurance that they don’t or only rarely use. However, insurers don’t reward caution and fair play – even though this means less work and lower costs for them.

We don’t think this is fair.

This is why we have developed a disruptive peer-to-peer insurance concept, which rewards small groups of users with a cash-back bonus at the end of each year if they remain claimless: the claims-free bonus, which has been selected as shortlisted project at Word Summit Award 2015.

How does this all work?

Policy owners with the same insurance type form small groups. A part of their premiums is paid into a cashback pool. If no claims are submitted, the members of the group get some of their money back at the end of the year. The claims-free bonus is available for new insurances and can also be added to existing home contents, private liability and legal expenses insurances very easily – without any change in coverage, premium or provider.

You provide bonuses if groups go claims-free during a period. How does that work? Do policy holders really change their behavior in this model? What’s the role of insurance companies in your model? Do they benefit as well?

The claims-free bonus can be added to existing insurance contracts: A deductible is integrated into the contract, or rather, the existing deductible is increased to the maximum. The increased deductible comes along with a lower premium. The difference between the old contract without deductible and the new contract with deductible flows into the cash back pool.

The premium reduction allows the cash back in case of no claims. In case of a claim, the policy owner does not have to pay for the deductible himself because it is covered by the pool. Therefore, the policy owner profits from the low premiums of insurance contracts with deductible without having to take the risk of high expenses in case of claims.

As the claims-free bonus rewards careful and fair behavior, we record a claim frequency below market average. For insurance companies, improved behavior means reduced cost of claims and also reduced processing cost for small claims.

Additionally, the claims-free bonus helps to increase customer satisfaction as well as customer loyalty. Currently we are cooperating with approximately 70 domestic insurance partners.

You’re active in Germany — will friendsurance model extend internationally? Do you have expansion plans?

Friendsurance has always been planned as international project. We are currently checking expansion possibilities in other markets.

It feels like the insurance industry is ripe for disruption but fewer firms are focused there. Why do you think that is? Why did you target this industry when you created friendsurance?

That there are few startups may be due to the fact that the insurance industry is still very regulated and lacks trust, making it hard to convince consumers of new ideas. You need long vision and patience. But we can see a change: Recently more and more startups are entering the insurance market.

Can you give readers a taste for what else you have planned with the product/service in the future?

We plan to offer additional insurance categories and expand to other markets.

[x_share title=”Share this Post” facebook=”true” twitter=”true” linkedin=”true” email=”true”]

Get off the investment roller coaster by getting the Lending Club gospel

Lending Club produced a nice new video I liked and thought you’d appreciate seeing.

In 5 years, the firm has underwritten over $1B in peer-to-peer loans and is on fire. As I’ve written before, I believe the direct personal loan is on its way to becoming a new asset class in investor portfolios, thanks to Lending Club.

Additional resources

- Listen to my interview with Lending Club founder and CEO, Renaud Laplanche

[listly id=”1Ds” theme=”light” layout=”full” numbered=”yes” image=”yes” items=”all”]