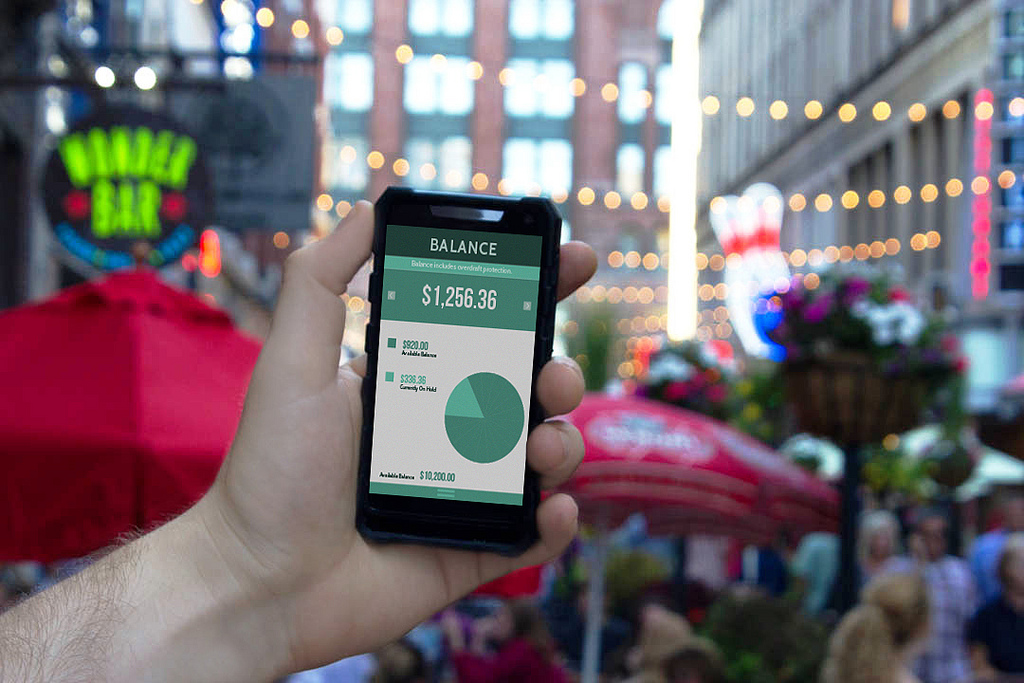

Paying the sitter: where social, payments, and taxes collide

High Five! The five fintech stories we’re following this week

Has PayPal soured on crowdfunding?

Swipe for charity: How mobile apps are enabling a future of giving

Venmo wants to power B2C payments, not just P2P

In today’s market, is everyone an online lender?

How do you compete when everyone’s an online lender?

The interest surrounding online lending has seen hundreds of millions billions of dollars (debt and equity) being poured into the space. In fact, the amount of money raised by US online lending startups through Q3 2015 was greater than all of 2014. Most of this capital has gone to pureplay startups — like $275M to Earnest, for example) to build out their technology stacks. Marketplace lenders have raised huge amounts of capital — from both the private and public markets — to attempt to get a foothold in the massive lending market. Online balance sheet lenders are participating heavily here, as well.

But that’s not all that’s happening. Ecommerce firms, without a traditional focus on finance, are getting into the action. PayPal just announced it had surpassed $1 billion in working capital it extended to its merchants. Amazon is expanding its lending program to sellers in multiple countries around the world. Chinese ecommerce sites and social networks and now, with Baidu getting into the game, a search engine, are providing financial services. And there are smart investors like Blue Elephant’s Brian Weinstein providing capital to get access to these new channels of finance.

So what does the market look like when everyone turns into an online lender?

Banks being disrupted…by search engines?

Traditional banks are finding out new competition lurks everywhere.

Pureplay startups like marketplace lenders, Lending Club and Prosper are originating billions of dollars of loans every quarter. Though volumes are small compared to total SMB outstanding loans (which in 2013 stood at $585 billion), some banks are turning to the marketplace lenders to buy loans, opting to partner instead of compete.

This move towards alternative lending, core to banking services, isn’t just a US phenomenon. Funding Circle, another leader among the current class of startup online lenders, has global aspirations.

Funding Circle’s co-founder, Sam Hodges recently explained to Tradestreaming:

Our vision for Funding Circle is as a global lending exchange, where business from all over the world come to find finance from an army of investors, big and small. Small businesses are underserved in most of parts of the world, and we believe our marketplace model can help millions of businesses and investors to get a better deal. At the moment, we are focusing all of our energy on building a successful business here in the UK, USA and Europe.

There are high hopes for marketplace lending. Some investors, like Foundation Capital’s Charles Moldow, are betting on the market, between cannibalization and traditional banks moving into marketplace lending themselves, can grow to be a trillion dollars.

From banks to ecommerce platform

It’s not just marketplace lenders taking aim at banks. Traditional ecommerce players want in, too. Amazon is offering loans to handpicked sellers on goods on its ecommerce platform.

Like marketplace lending, ecommerce firms entering financial services isnt’ just happening in the US: PayPal’s Working Capital loans for small businesses has lent more than $1 billion to over 60,000 small businesses in the U.S., U.K. and Australia. Alibaba, the giant Chinese ecommerce platform, launched a money market fund for sellers to store their working capital. Within just 10 months, the fund, called Yu’e Bao had more than $90 billion in short term capital. That’s money that used to be kept in banks.

Search engines becoming lenders

On the heels of Alibaba’s success in money markets, Chinese search engine Baidu appears ready to launch its own banking solution. Looking to avoid some of the regulatory commotion around Alibaba’s own financial service offering, Baidu intends to partner with Citic, the 7th largest Chinese bank with 600 physical locations.

While Google got out of the direct lending business to its advertisers, it is now running a pilot with Lending Club. The marketplace lender is offering advertisers on Google a loan to fund their AdWords campaigns.

The nature of banking is changing and therefore, the players leading the charge are rearranging themselves. [x_pullquote cite=”TechCrunch” type=”right”]This year, over $11 billion has been invested in financial technology services companies. That’s up over $5 billion from the previous year, and the highest amount invested into financial services technology companies in the past five years[/x_pullquote]Pureplay lenders are filling an important role and ecommerce platforms have found a way to offer financing to some of their best customers. As this plays out, there are more companies popping up to help banks compete. Firms like LendKey provide banks with the tools, technology, and process optimization employed by nimble tech startups. More companies keep launching to help make the banking sector more competitive to the demands placed on them by consumers who are demanding the same speed, transparency, and service commonplace in other industries disrupted by technology.

This opportunity hasn’t been lost on investors, who are pouring money into alternative financing businesses. Lending Club and OnDeck both had well-received IPOs that gave the companies billion dollar marketcaps.

In 2015, there’s been hundreds of millions of dollars invested into alternative lenders. Just this week, alt lender Earnest announced a round of $275 million (equity and debt).

Regulation and branding will assure that banks aren’t going away but it’s getting more complicated to compete in core banking services. Direct competitors are emerging to challenge banks head on while others, like ecommerce players, are indirectly competing indirectly with them. Through general growth, partnerships, and some disruption, the banking industry is quickly evolving.

[x_author title=”About the Author”]