Oh, Danny Boy: The top 5 things to know about Irish fintech

What fintechs and credit unions have learned from each other

Lemonade Insurance: I do not think P2P means what you think it means

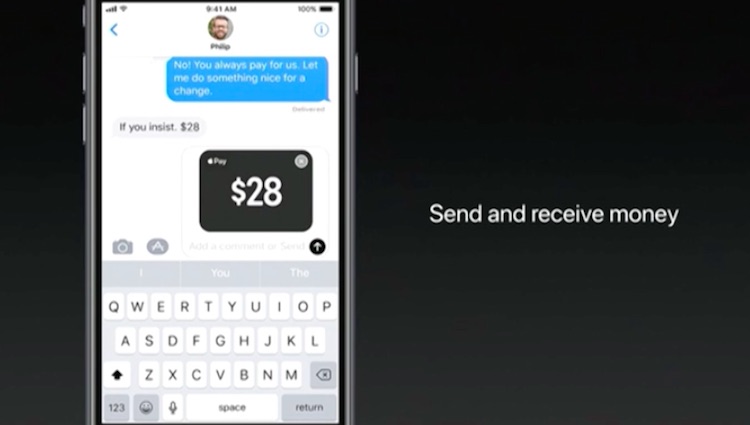

Venmo who? Fiserv expands P2P payments to more Americans

Big banks prepare to crush p2p startups with clearXchange

Chase Pay lands deal with Shell, access to 20 million daily customers

[podcast] Where Blue Elephant’s Brian Weinstein is finding opportunity investing in marketplace lending

In Brian’s investment universe, the world is starved for yield and addicted to liquidity. When looking for his next investment, Brian and his firm pore through loan portfolios that are accompanied by lots of data to stress test performance assumptions. In his world, banks really ARE good at lending, so he’s looking at spaces where the banks aren’t participating as much in a pursuit for returns.

Brian joins me to discuss how peer to peer investors like him find opportunities by filling in some of the voids left behind by banks. We’ll hear what types of peer and direct lending he’s looking to invest in and what spaces he’s avoiding. We’ll also talk about boat finance. Yes, I said it, boat finance.

Listen to the FULL episode

What you’ll hear on this podcast:

- Brian’s story of how he got to Blue Elephant: Why Brian left his PM role at BlackRock, managing $100B, to pursue investing in the burgeoning field of marketplace and direct lending

- The type of research Brian and Blue Elephant conduct to determine the investability in loan portfolios coming out of marketplace and direct lenders

- What spaces in direct lending Blue Elephant is looking at and which investments it’s staying away from

- Why Blue Elephant likes the boat finance industry

- Brian’s view on what banks are really good at and where they aren’t (or don’t participate)

- Whether institutional investors should take equity positions in the marketplaces they participate in

THIS WEEK’S SPONSOR

This week’s episode of the Tradestreaming Podcast was sponsored by Collective2 — automated trading for humans.

Choose one of the thousands of automated trading strategies at Collective2, and trade it in your brokerage account.

To learn more, go to www.collective2.com/tradestreaming and as a Tradestreaming listener, you will get $55 off the first strategy you publish to Collective2.

MORE RESOURCES

- Blue Elephant Capital Management (website)

- Brian Weinstein discusses boat finance and the investment opportunity (Tradestreaming)

EVEN MORE RESOURCES

Photo credit: Beshef via Visual hunt / CC BY

Why I’m a converted believer in investing in P2P loans

If you’re like millions of people, you’re probably worried about your net worth.

Pretty worried.

The market’s up and then, it’s down. Jobs are being created and lost. Banks are stable and then they lose $3B seemingly overnight. And politicians? Nobody seems to have a strong plan to get us through and certainly not the political will to see it through.

It’s not entirely clear if the economy is recovering or not.

Investments: riskier, less diverse, zero confidence

If you have investments, you’re probably experiencing the following:

Volatility spikes: The market has the great ability to lull people into a false sense of security and then, wham! You get periods like the beginning of May where it feels like the world is ending. Nothing looks good right now. Nothing feels right, either.

Diversification doesn’t seem to be working: It may be exchange traded funds doing it or just a general move towards passive investing, but all types of investments are moving more in tandem. When stocks go down, they bring down other “safer” assets. The theory of diversification isn’t providing the benefits it promised. That’s where we are — when things are bad, it seems that there is nowhere to hide.

Lack of confidence in reaching financial goals: Many investors are just throwing up their hands. No más. They feel the stock market is rigged (it is, somewhat) and don’t want a part of it. But in an environment where bonds and CDs pay so little, underfunded-for-retirement investors need to reach for more risky assets and are forced to play a game that they don’t want to play.

What if I could tell you that you can triple the returns on the fixed income (bonds) part of your portfolio without taking on more risk?

Continue reading “Why I’m a converted believer in investing in P2P loans”