Newspapers, magazine, bloggers — the financial press — get up every morning of every day (yeah, I’ll include weekends) to try and figure out what the future has in store for investors.

The investing weathermen

When my kids ask me what I do, I tell ’em and receive comments like “Why can’t you run a supermarket?” They understand inventory and selling products. They don’t understand investing and why it’s so hard to predict what the future has in store for markets and individual assets.

I frequently come back to the question and tell them that I’m like a financial weatherman, trying to determine what type of economic weather we’ll have next week, next month and next year.

They sort of get it and at least their eyes stop glazing over.

But, it’s an interesting metaphor — investing and weather forecasting.

Like meteorology (another famously frustrating trade), forecasting the markets, the unknown is tricky.

But unlike the investing field — which keeps reams of historical data for comfort and scientific value, you’ll be surprised to know that until relatively recently, meteorologists didn’t even keep historical data.

Eric Floehr monitors weather forecasts for a living. Here’s what he had to say about when he started researching the accuracy of weather forecasters:

I have this data back to 2004. It’s funny, but most weather forecasting companies historically have not kept their forecasts. Their bread-and-butter is the forecast in the future. Once that future becomes the past, they saw no value in that data until recently.

For weathermen, what matters is uncertainty. Outside of taking a cruise during a typhoon or getting rained out of a golf match, getting the weather wrong doesn’t really impact my life ALL that much.

Unlike investing where bad bets can be ruinous.

Time and uncertainty

As I wrote about measuring investment risk, risk is more than just uncertainty. When we invest and make decisions based upon an unknown future, we also have to factor in what would happen if we get it wrong.

That’s the difference between losing some short-term money and having to push off retirement for many years.

Part of our struggle with getting our hands around risk is our relationship with time. It’s easy to plan for tomorrow, which is why accuracy for The Weather Channel is MUCH higher in predicting the following day’s weather than it is for the 7-10 day forecast).

Time and risk are two sides of the same coin:

Time is the dominant factor in gambling. Risk and time are opposite sides of the same coin, for if there were no tomorrow there would be no risk. Time transforms risk, and the nature of risk is shaped by the time horizon: the future is the playing field.

Peter L. Bernstein. Against the Gods: The Remarkable Story of Risk (Kindle Locations 187-189).

Investing is a very complicated game. At risk is our future but the future defines how much risk we’re going to take on today.

So-called financial experts are merely signposts along the way, providing frequently misleading and oftentimes, wrong advice on how to navigate through the uncertainty.

Understanding risk — and really, it’s about personalizing risk (my risk is different than your risk for the same time frame) — means understanding that the future is the playing field of risk. Most of the bloggers and financial media are just noise along the way.

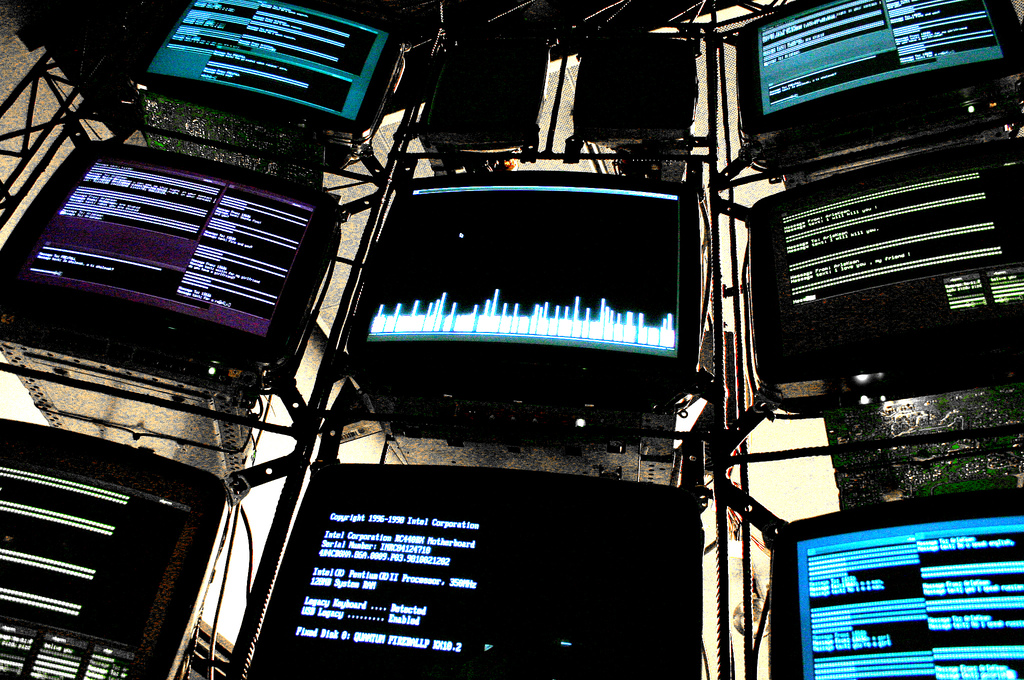

picture by salin1