Ramp’s AI-powered push to automate expense management ft. Geoff Charles

- Geoff Charles, Chief Product Officer at Ramp, discusses how AI is making expense reporting obsolete and reshaping corporate finance workflows for businesses of all sizes.

- Learn how Ramp is evolving from a corporate card provider into an intelligent financial partner that saves companies time and money through automation and AI-powered insights.

I recently sat down with Geoff Charles, Chief Product Officer at Ramp, to discuss the rapidly evolving landscape of corporate finance technology. Recently promoted to CPO, Geoff has been with Ramp since its early days when the company was just 10 people. His journey from product manager to C-suite exemplifies Ramp’s growth trajectory as a company now hiring hundreds of employees annually.

“We’re continuing to really push leaders to build capabilities with their reporting lines,” says Charles. “It’s important for us to continue scaling and promoting internally, which is a big part of our culture at Ramp — to find early talent, to mentor them, to grow them, and to give them unlimited growth potential within the company.”

Geoff describes the product culture at Ramp as “intense,” with product managers serving as the “pace keepers and pacemakers” of the tech organization. This culture of speed, decision-making, and customer-centricity has helped position Ramp as an innovator in the corporate finance space. The conversation explores how AI is transforming traditional expense management, the strategic importance of owning transaction data, and the opportunities in automating financial workflows.

Ramp’s Evolution: From Smart Cards to Financial OS

Ramp launched with a smart corporate card that eliminated the need for traditional expense reports. Over time, they’ve expanded into accounts payable, treasury management, and broader financial operations. “The job to be done here is how you allocate capital within the company in the most effective way,” explains Charles. Effectiveness means minimizing time spent while maximizing ROI on every dollar spent.

AI has become central to this mission. Charles notes that the average employee isn’t hired to do expenses and doesn’t have a finance degree: “Our latest models that are coding expenses for you are more accurate than the average employee.” This focus on automation saves valuable time for both employees and finance teams.

AI as a Gateway to Broader Adoption

Charles sees Ramp’s AI features as a potential entry point for enterprise AI adoption. “Most of the products that you’re already using have some type of AI,” he explains. The key differentiator is the governance layer that ensures accuracy and maintains human oversight when needed.

Ramp approaches AI implementation through a framework that considers two dimensions: how good humans are at a task versus AI, and how critical it is for that task to be done correctly. They started with tasks where humans traditionally perform poorly (like expense coding) and where small errors aren’t critically important to financial records.

Building Trust in AI-Powered Finance

For companies like Shopify and Airbnb that use Ramp across thousands of employees, trust is essential. Charles emphasizes the importance of transparency in AI implementation: “What’s important for us when we’re building AI is to know how certain we are that this is the right action.”

Ramp provides finance teams with confidence metrics, audit capabilities, and sampling workflows, allowing controllers to understand where they need to pay attention. The system continuously improves by incorporating feedback from human overrides. “Our vision is to move from 5% automation to 20% automation to 100% automation over time,” says Charles.

The New Treasury Product: Money on Autopilot

Ramp recently launched a treasury product designed to help companies earn interest on idle cash. The genesis came from observing that many clients kept funds in low-interest accounts, even in high-interest environments. “Most CFOs or CEOs are not Treasury experts,” Charles notes, explaining that managing cash across accounts is complex and time-consuming.

Leveraging their visibility into both cash positions and outflows, Ramp designed a solution that puts “money on autopilot.” The system provides real-time visibility, instant liquidity for payments, and optimized returns by timing investments based on projected cash needs. Following the SVB crisis, Ramp also implemented a bank network that stacks FDIC insurance for additional security.

Balancing Technology with Human Expertise

While Ramp is heavily invested in AI capabilities, Charles recognizes that certain tasks still benefit from human judgment. For critical, high-risk actions like processing large, unfamiliar vendor invoices, Ramp utilizes a hybrid approach. Their systems flag potentially fraudulent transactions and implement risk-based approval workflows.

“We’re moving to a world where employees are basically having conversations with the Ramp AI when they’re doing their expenses,” says Charles. This conversational interface can handle policy exceptions, clarify ambiguous charges, and determine when employees need to reimburse the company — all without manager intervention.

The Big Ideas

AI as a Financial Co-Pilot: “The average employee doesn’t have a degree in finance… our models are more accurate than the average employee,” Charles explains, highlighting how AI can democratize financial expertise.

Unified Financial Operations: “Why is it that you see receipts for expenses in one product and accounts payable in another? Makes no sense,” says Charles about the fragmented finance software landscape Ramp aims to consolidate.

Selective Automation: Charles emphasizes their approach to automating what makes sense: “Where there’s high criticality and where humans are very good at it… we need to be very cautious with where we apply AI.”

Financial Data as an Asset: “Because everything happens on Ramp… we know with your location, we know the receipts, we know the actual request,” Charles explains how comprehensive data improves AI accuracy.

Self-Disruption as Strategy: “If you don’t build the thing that kills you, someone else will,” says Charles on Ramp’s proactive approach to reimagining their products in an AI-first world.

Listen to the full episode

Subscribe: Apple Podcasts I SoundCloud I Spotify

Watch the full episode

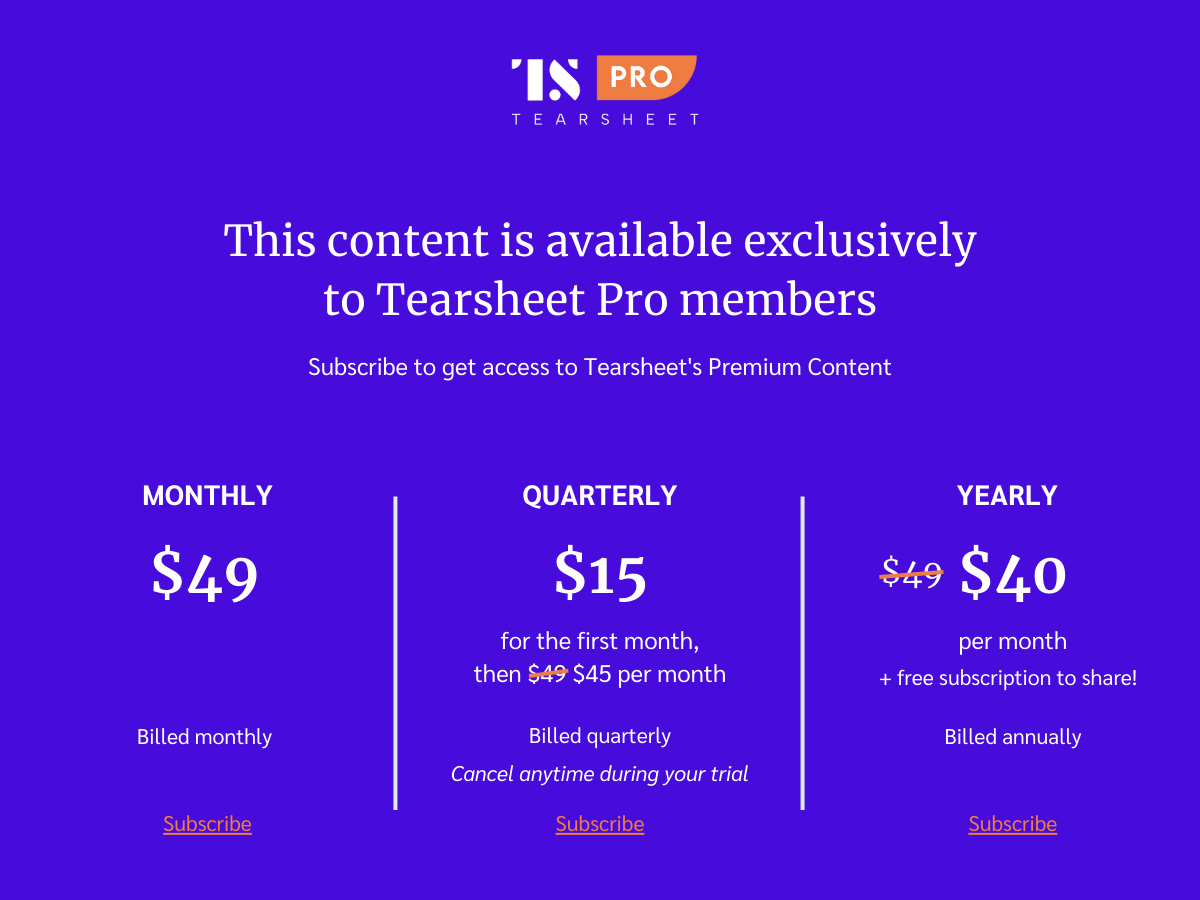

Read the full transcript (for TS Pro subscribers)