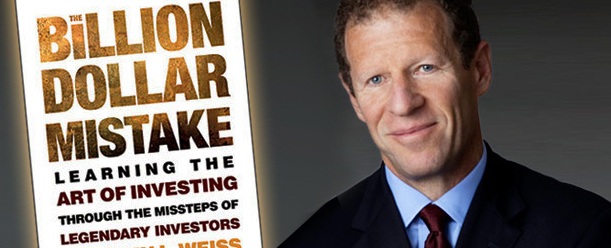

In this week’s episode of Tradestreaming Radio, we interview Stephen Weiss, author of the newish book, Billion Dollar Mistake: Learning the Art of Investing Through the Missteps of Legendary Investors. You can also find a full transcript of the show here.

Weiss had a long-spanning career on Wall Street (Oppenheimer, Salomon, Lehman) where he covered many of the top hedge funds and even spent part of his career helping run Stevie Cohen’s SAC Capital. He took some great insights and made them even more interesting: by focusing on the mistakes top investors have made.

We discuss:

- Why mistakes are better learning experiences for investors than winners

- Why passion is not an investment strategy and why Kirk Kerkorian loved American cars too much

- How Omega Advisor’s Leon Cooperman plays and manages risk in emerging markets

- Why Bill Ackman made loot on Barnes and Noble ($BKS) but lost a ton on Borders ($BGP)

- How these takeaways are applicable to individual investors

I really enjoyed this discussion with Weiss not only because it was an interesting view into the investing patterns of the world’s best investors but he’s distilled his experiences into a real discipline.

One really compelling insight I think we can all take away from The Billion Dollar Mistake is that it’s hard to discern whether successful trades were skillful or just lucky. Trading losses provide an opportunity for investors to reckon their processes.

More Resources

- check out the podcast above (or, if you don’t see it, here). If you use iTunes, our program can be found here

- Tradestream radio archives

- full transcript of the show