Online Lenders, Podcasts

Deserve’s Kalpesh Kapadia: ‘We promise the best credit card for our customer’s profile and life stage’

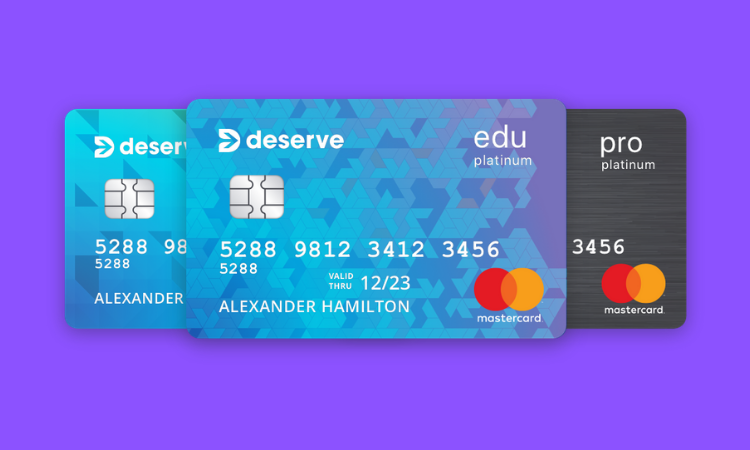

- Young students were practically shut out of the credit system -- even worse for foreign students.

- Deserve uses data to issue credit cards to foreign students.