Library, Partner, Podcasts

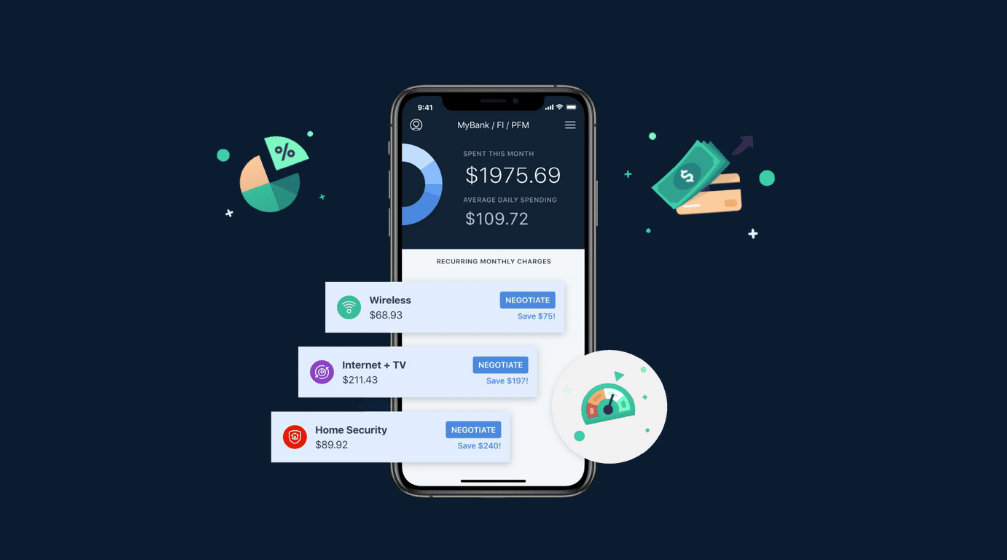

Case study: How Intuit’s newest upgrade of Mint helps consumers save on bills and subscriptions

- In our latest case study, we spoke with Intuit Mint and ApexEdge about how they enable better money decisions and financial wellness.

- Listen in or read through our conversation with Varun Krishna and Steven McKean about building and launching a partnership that takes PFM further.