Navigating the subscription economy: Pricing, experience, and data

- While businesses remain confident about growth, rising inflation and consumer cost-consciousness are driving increased churn, forcing companies to rethink their retention strategies in an increasingly competitive market.

- Dive into how businesses can combat subscription fatigue through strategic pricing flexibility and consolidated management solutions, while leveraging AI and first-party data to predict churn and personalize customer experiences at scale.

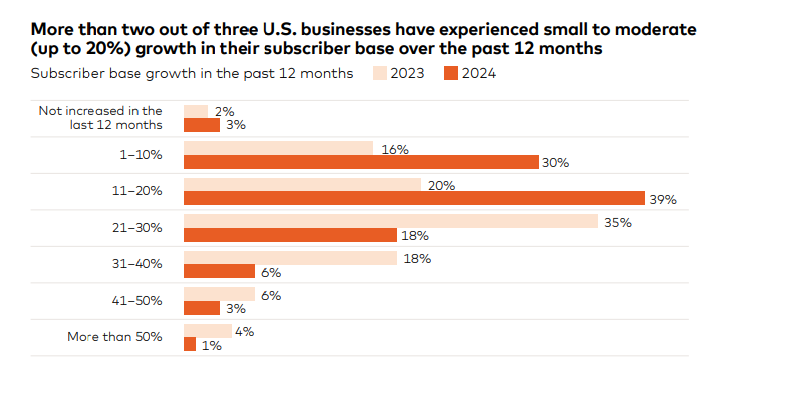

Despite macroeconomic turbulence, U.S. subscription-based businesses are continuing to see growth, with 89% reporting they are confident about increasing their recurring revenue in the following months, according to research by Mastercard.

Although the research shows resilience in times of economic uncertainty, there is a slight drop-off in year-on-year revenue growth: 35% of U.S. businesses saw subscriber growth of 21-30% in 2023, compared to only 18% of businesses achieving this growth rate in 2024.

Subscribers are now more discerning and harder to keep

Rising inflation is knocking at the door, and consumers are becoming more discerning about which subscriptions they intend to keep: More than one-third of U.S. consumers report that they are spending more compared to 12 months ago, mainly due to increased prices by service providers and data also shows consumers prioritize “saving money” when canceling their subscriptions.

This is leading to subscription businesses like streaming services are facing constant comparison as consumers juggle more than 3 subscriptions on average. This has pushed Over-the-Top (OTT) providers to enhance value through flexible subscription options and lower-priced ad-supported tiers.

Along with the number of subscriptions per consumer, overall spend has also increased with customers spending an average of $118 in subscriptions monthly. Over half of all consumers are now closely tracking how much they spend on each service. For businesses, this means that the right pricing strategy can be the difference between retention and churn.

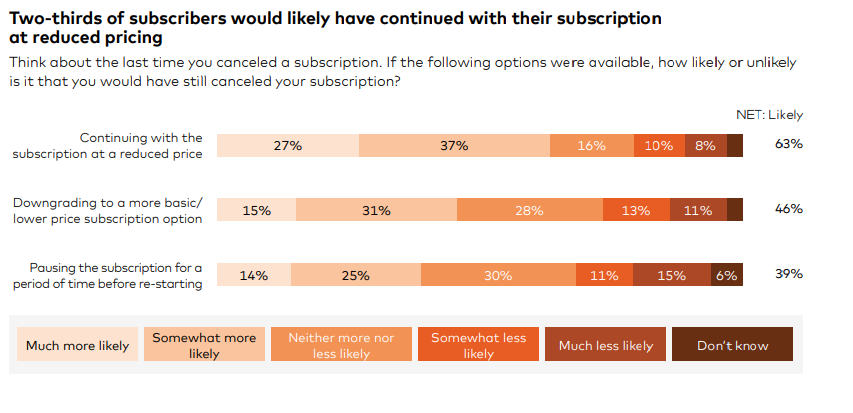

In fact, if businesses had reacted in time, 63% of consumers would have continued with the service at reduced prices, and 46% would have stayed with the service but downgraded their plan if the option was available.

Beyond changing the pricing matrix, businesses can also benefit from offering consumers optionality in how they manage their relationship with a service provider: 39% of subscribers report that they would have considered pausing their subscription and then re-starting it, instead of cancelling it entirely.

Pricing and customer experience can reduce churn

To optimize subscriber experience, businesses need to implement strategies that would add value for consumers over time, reduce the cognitive load of managing subscriptions, and ease key actions like signing up, canceling, and pausing.

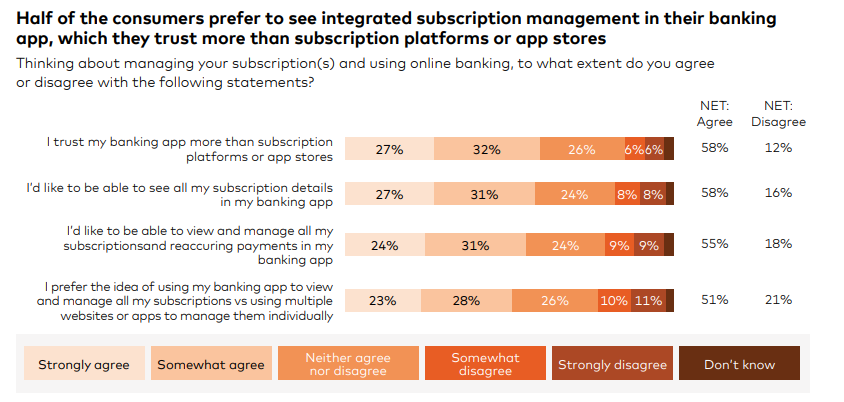

Many of these key customer experience (CX) improvements can be made by allowing consumers to manage subscriptions through a consolidated subscription management solution: Nearly three-quarters of consumers express interest in an all-in-one subscription management solution, yet only 2% actually use one. The gap shows that businesses are sleeping on a strategy that could significantly bolster their retention rates and set them up for a future where subscription-based services continue to proliferate in the market.

For most consumers, this all-in-one solution would be best hosted in their banking app – a space in the digital finance realm which 58% of the consumers trust more than subscription platforms or app stores. And more than half of the consumers would prefer to view and manage all their subscriptions and recurring payments through their banking app, according to Mastercard’s data.

This creates an opening for banks and fintechs to capture this audience by enabling subscription visibility and management, while partnering with subscription services to deliver bundled offerings. Since most consumers consolidate recurring payments on a single card, capturing this spend drives payment volume and interchange revenue – with repeat engagement and seamless experiences being key to winning that consolidated spend.

“As part of the ongoing value exchange in the subscription economy, businesses need to focus on enhancing flexibility, convenience and control for customers. Consumer demand has led to the emergence of new channels to manage subscriptions, such as banking apps and aggregators. By offering subscription management, banks can increase revenue, reduce chargebacks and OPEX, and enhance engagement and trust. Subscription businesses can retain, win back and grow subscribers,” said Gaurav Mittal, Executive Vice President, Ethoca by Mastercard.

Enhancing the data layer in the subscription economy

Beyond optimizing experience and pricing, businesses also need to invest in AI to drive strategic business applications like churn analysis, data segmentation, and propensity modeling. Success requires structured first-party data with proper workflows and taxonomies (e.g., metatag hierarchies) to ensure accurate, non-hallucinatory AI outputs.

At the moment there is a significant gap in data collection strategies and deployment: Despite 83% of businesses prioritizing first-party data collection and widespread AI investment plans, only 41% have actually implemented AI solutions.

The implementation gap suggests companies aren’t maximizing AI’s potential alongside their data strategies. Early adopters using AI for customer service, retention, and product enhancement are gaining competitive advantages.

As the subscription economy gets more competitive, businesses will need to optimize for three critical drivers: pricing, CX, and leveraging AI to drive more than just one-to-one personalization and instead bake AI into long-term strategic applications that drive retention and monetization.

To learn more about subscriber behavior, growth strategies, and how AI can boost subscription-based business models, download Mastercard’s research here.