March, don’t run: Current’s story is a masterclass in building a neobank

- Current is reporting massive growth at a time when most fintechs are struggling to build a path towards profitability.

- Discover how the fintech is applying its learnings from the past and has built out its product mix to create a suite of offerings that cater to everyone.

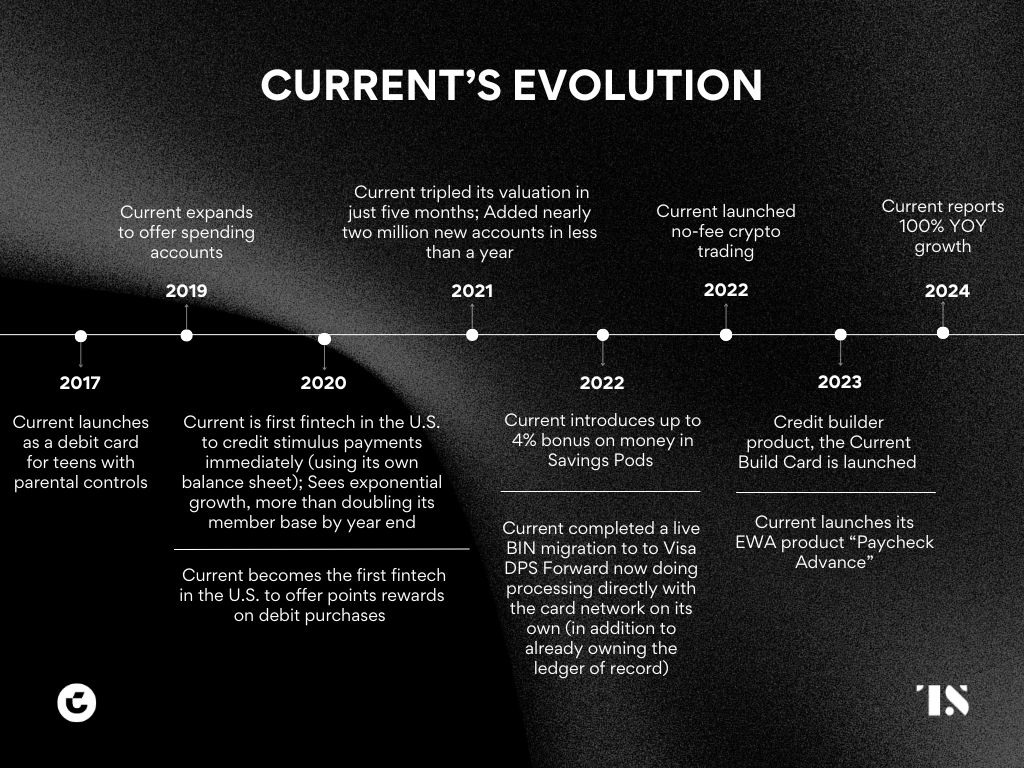

With Current’s recent report of 100% year-over-year growth, we sift through the sands of time to unpack how the firm has evolved from its first product for teens to offering full financial solutions for everyone.

While tracking Current’s progress through the years, it becomes clear that the firm’s execs, CEO Stuart Sopp and CTO Trevor Marshall, have a play-by-play strategy to growth: Each addition to Current’s product mix creates learnings that echo into the firm’s future.

For example, from 2017 to 2019, Current learned how to build a differentiated card product for young consumers and how to capture consumers early to build relationships that can evolve with them. These learnings are what the firm is now using to market and build momentum for its Build card. The firm’s strategy is to lay down a strong foundation and then build their value proposition by launching products to enhance their core offering.

By launching a brand that was aimed at teens first, Current was not only able to crack what it takes to lock in young consumers but it also fostered relationships that matured with the fintech itself.

Moving with the customer: Current’s strategy behind the Build Card and Paycheck Advance

Demand is the difference between a fad and a loyalty-building product. And building for stickiness is Current’s strong suit. The firm is really good at identifying what its core consumer segments need and then introducing offerings that make sustaining the relationship worthwhile for the customer.

The first step to doing this well is to identify who to build for. Current is focusing on those who are underserved by traditional FIs and are living paycheck-to-paycheck. This focus speaks to a larger societal need: Currently two-thirds of Gen Z are living paycheck-to-paycheck.

While core offerings that come with no fees are already attractive for this segment, allowing this segment to improve their financial wellbeing is the next step in what banking can do for these consumers.

“There is an increasingly massive demographic of America that is experiencing a climate where jobs have changed and cash flow has changed. So cash flow underwriting is really important, but it’s also very complex. We’re uniquely positioned to really satisfy and serve these customers in that way. We provide really valuable liquidity,” said Sopp in a recent Tearsheet podcast.

Current is solving for this consumer need through its credit builder card and EWA products:

- Build Card: Current’s credit builder card is a direct answer to a rising concern about the decline in consumers’ overall financial health. It allows customers to reassert control over their financial futures at a time when macroeconomic conditions are leading to a decline in income and savings for many.

“We’re looking at 10 to 20 points [credit score improvement] within the first month or two. And so it’s a great product for our customers because the debit and their secured credit card are deprecating one balance,” said Sopp.

- Paycheck Advance: While the Build card allows customers to build a better future, the firm has also added a product – Paycheck Advance – that allows them to access liquidity in the present.

“I think that there’s a lot of pressure on the middle class and on the household. And so this product is just at the right time for the populace as well,” said Sopp.

Since Current has a “banking tail” according to Sopp, the firm does not rely on its Paycheck Advance product for its bottom line. The advantage of this is two-fold: First, customers get access to a product that is built around their needs. And second, Current is able to onboard customers into its larger product suite through the on ramp that Paycheck Advance offers.

Growth is not a magic trick

The firm has spent years enhancing the capabilities of its core technology and learning how to integrate its product mix step by step and has been following changing regulation closely:

“So when it came to Early Wage Access, or PCA products, I was put off by the industry a little bit until about a year and a half or two years ago. Then, you started to see a shift in regulatory requirements and compliance. So in regulation we started to see the federal system talking more positively about it: What we should probably do is regulate, get licensing by states,” said Sopp.

Current has mastered the skill of keeping a close eye on regulations and skating to where the puck is going to ensure it stays compliant and competitive. The firm is now putting this skill to full use in its EWA product.

However, building with caution and so that no “dark patterns” are used and developing your own tech in an iterative manner takes time.

“Everyone says: oh you launched that in nine months. We did… but really, it was building upon a lot of hard work at the company to get to that point,” said Sopp.

Even as the industry is expecting fintechs to start looking for IPOs and attain profitability, for Current this is a march, not a race.

If you want to dive deeper into Current’s journey and how it achieved massive growth, click here to download an in-depth case study.