Payments are the new OS for SMBs: How every business decision can trace back to a payment flow

- Payments are becoming the new operating system for small businesses.

- Drawing on new datasets from Zelle and Bank of America, we connect the dots on SMB payment trends -- and illustrate them with a case study that converts data into decisions.

Once treated as routine bookkeeping, cash flow is now the engine room of SMBs, driving decisions that ripple beyond the balance sheet.

This shift also reframes the stakes for financial firms that serve SMBs. The rise in digital payments tells part of the story; the deeper narrative is that whoever owns the payment layer can effectively lay down the core infrastructure for SMBs.

Looking at fresh datasets from Zelle and Bank of America, we map out SMB payment trends and ground them with a case study that translates numbers into action and real-world takeaways.

SMBs’ growing digital transaction flow and the trends it signals

i) Zelle: Growth in digital transaction volume

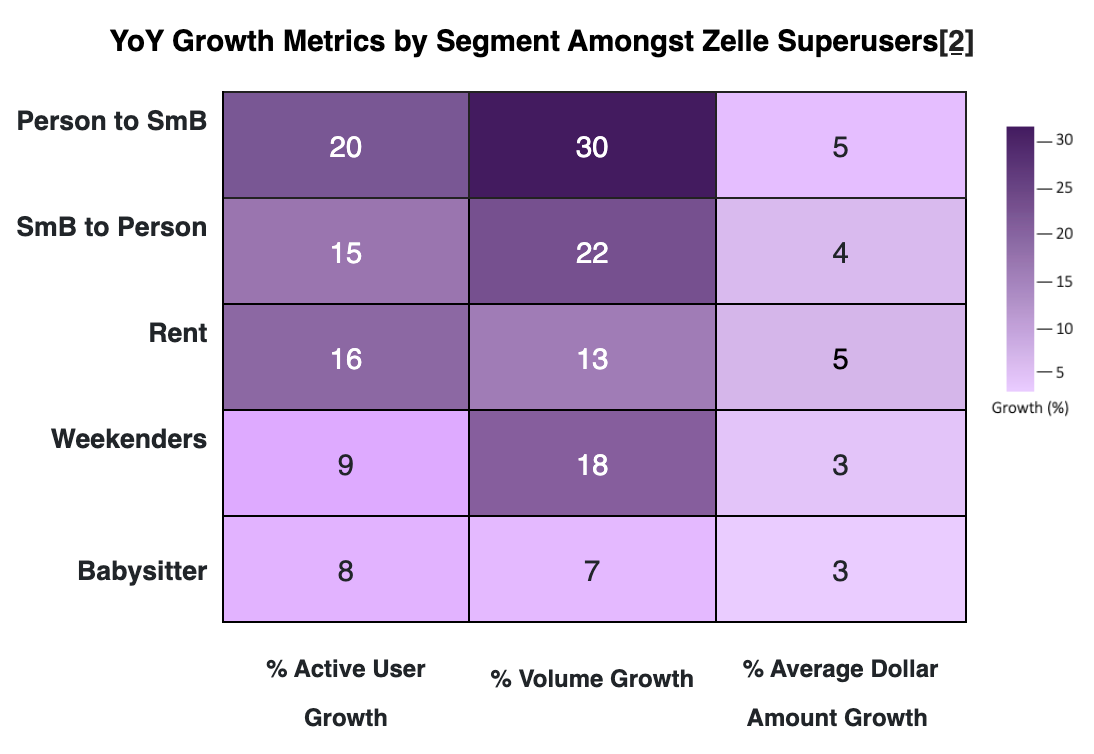

New data from Zelle sheds light on how active SMBs are in the digital payments space.

In H1 2025, US consumers and SMBs sent and received 2 billion payments, reflecting a 19% growth year-over-year.

Consumer-to-SMB transactions increased by a sharper 31%, with the average payment rising 5%. According to Zelle, payments to SMBs represent its fastest-growing use case.

Zelle is becoming a two-way street: consumers are paying small businesses directly, and in turn, small businesses are using the platform to pay their contractors and gig workers: payouts on the platform to individuals rose by 22% year-over-year.

ii) Bank of America: Payments as a real-time barometer of SMB health

Zelle’s numbers point to the swell in digital transactions among SMBs, but Bank of America’s data across key facets of SMB payments draws the contours of the story more clearly.

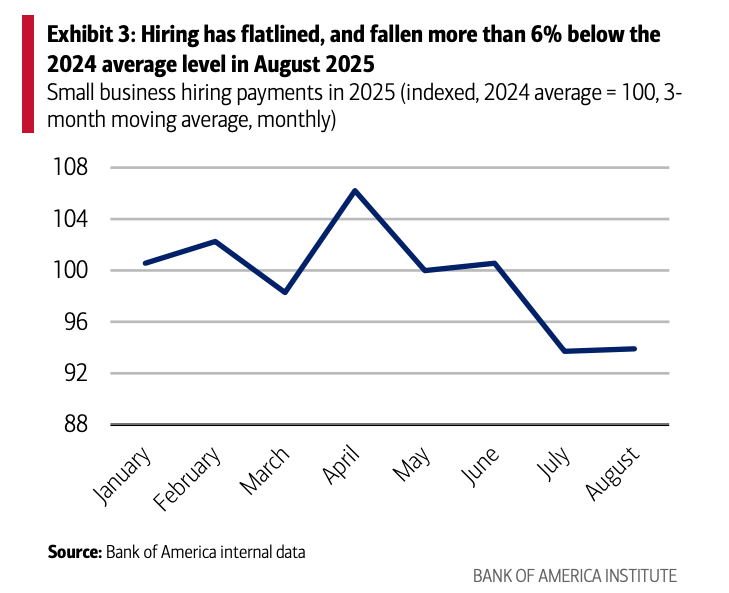

Bank of America’s recent Small Business Checkpoint shows a close-up of how payments now function as a real-time strategy map for small firms. Among the bank’s millions of small-business accounts, total payment volumes rose 6.6% year-over-year in August 2025, but the standout signals come from two specific flows: hiring and technology.

On the labor side, payments to hiring firms have dropped more than 6% below their 2024 average, the lowest monthly level since early 2023. It’s a clear tell that many owners are delaying staff expansion in the face of tariffs and tighter margins.

But the pullback isn’t uniform. Construction and manufacturing firms are moving in the opposite direction, pushing hiring payments over 30% above last year’s baseline, using faster payouts to lock in scarce talent. The pattern underscores a new competitive lever: quick movement of payroll funds supports workers and also signals business strength in a tight labor market.

At the same time, payments to technology services are up nearly 10% from the 2024 average, revealing where SMB-owners are still willing to spend.

Seen through this lens, payments are becoming SMBs’ mainstay that drives every decision. Hiring choices, borrowing plans, technology investments, and even vendor negotiations all first appear in the transaction data.

This is where Intuit, which builds financial management tools for consumers and small businesses, picks up the thread. One of the firm’s recent strategies is to use agentic AI in QuickBooks to turn payment data into practical guidance for small businesses.

Intuit’s real-world move: Payments as an orchestration layer

Intuit is reimagining its accounting software platform, QuickBooks, as a payments-centered financial operating base that orchestrates the flow of businesses.

The firm has embedded AI agents in QuickBooks earlier this year, which build on the model:

- The Payments Agent predicts late invoices and adjusts reminders, stabilizing cash flow without manual chase-downs.

- The Accounting Agent flags unusual entries before they distort the books, reducing rework.

- The Finance Agent builds forecasts and dashboards rooted directly in payment patterns, offering a forward-looking view of cash flow.

Together, they make payments not the end of the workflow but the driver of every workflow.

Ashok Srivastava, Intuit’s Chief Data Officer, underscored that the system isn’t designed to replace human oversight, but to strip away friction and allow business owners to act on signals earlier.

“We’re not trying to remove humans from critical decisions,” he noted. “Our approach is about reducing the manual effort that bogs people down, while keeping them in control at every critical decision point.”

Intuit has been steadily building an ecosystem to position QuickBooks as a nucleus for SMBs. It acquired the HR platform GoCo and mobile-first credit card company Deserve earlier this year to embed payroll, compliance, and lending capabilities into QuickBooks. Paired with earlier acquisitions like Mailchimp (for marketing) and Credit Karma (for consumer finance), QuickBooks is being molded as a hub where every business decision – from hiring to customer acquisition – traces back to a payment flow.

Payments as the new SMB OS: The three pillars

The recent datasets and Intuit’s strategy point to one idea: payments are becoming the operating system for small businesses.

This transformation can be explained through three pillars:

- Cash flow as a differentiator: Instant payouts aren’t only perks, now they’re competitive advantages. SMBs that pay contractors and workers the same day retain talent. Cash flow becomes a differentiator in labor markets and vendor ecosystems alike.

- Data as an advantage: Payment flows reveal stress faster than traditional accounting cycles. Whether it’s eroding margins in the current climate or hiring costs spiking in one sector, payments data provide a leading indicator of business health. Control over payment data equals influence over SMB decisions.

- Integration as power: Standalone tools are giving way to orchestration layers. Payments move beyond transactions and emerge as the unifying layer for SMB accounting, HR, and lending in Intuit’s ecosystem.