Member Exclusive

Research: Bank branches are disappearing from rural America

- Banks continue to close branches around the US.

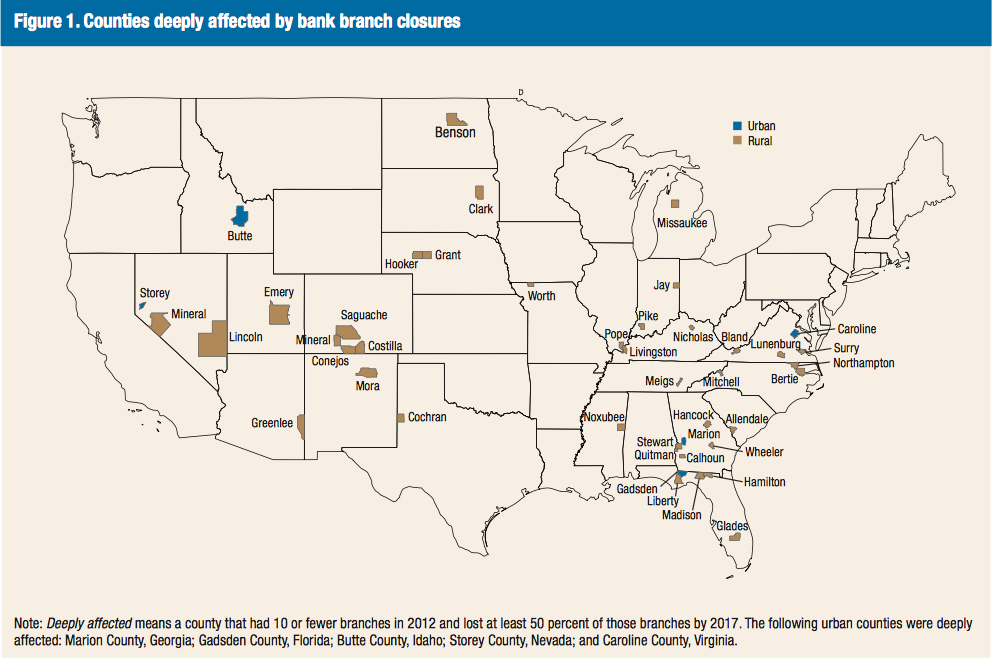

- While many communities have fewer branches today, poorer, more rural communities are hit the hardest.