Data Snacks, Member Exclusive

On the road, OppFi attempts to differentiate itself from the lending models of Affirm, Katapult, and Upstart

- Consumer lending apps may blend together but when you look at them, there are marked differences.

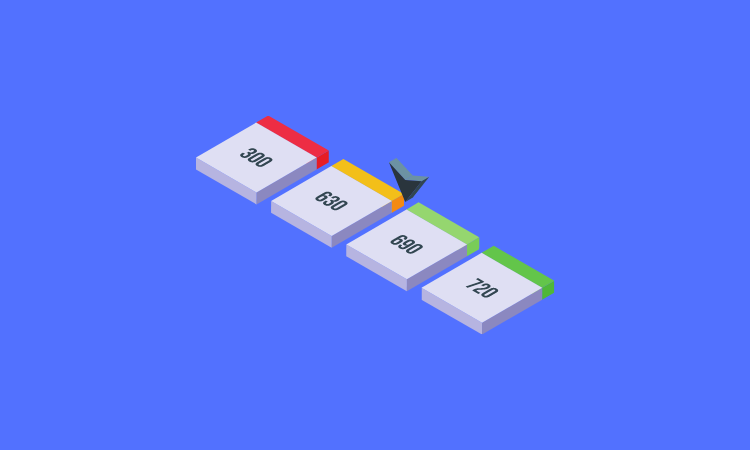

- Affirm, Katapult, OppFi, and Upstart weren't all created equal.