Data Snacks, Member Exclusive

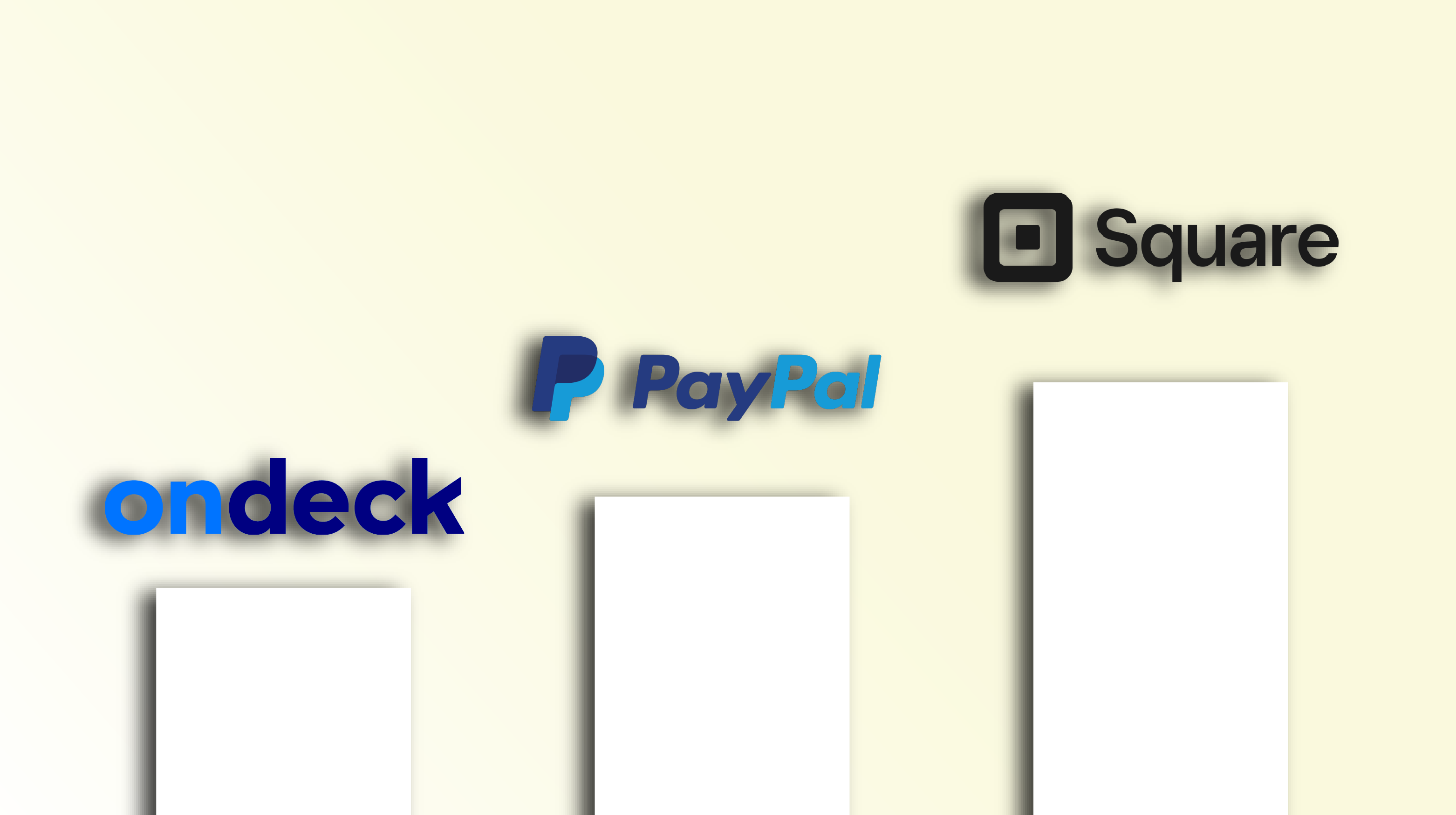

Data snack: Square ends 2021 as the top SMB digital lender by volume

- Square Loans closed 2021 at record small business loan origination levels - $2.5 billion - higher than its pre-pandemic volumes.

- The fintech also inched ahead of rivals PayPal and OnDeck for the first time, making it a market leader in the digital SMB lending space.