Data

How Wells Fargo is letting customers take back control of their financial data

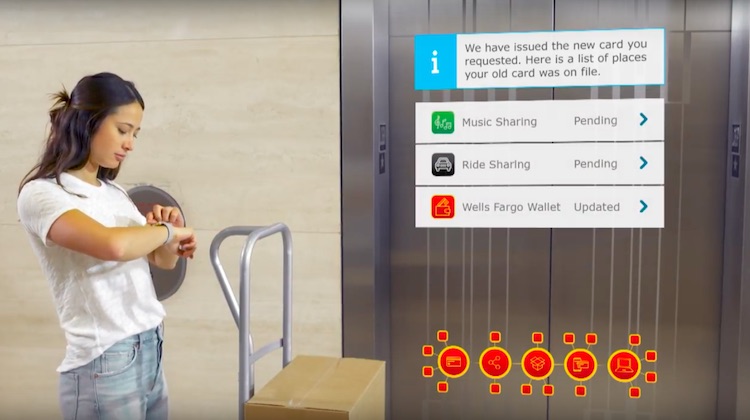

- Next year Wells Fargo customers will be able to view their financial digital footprint in their mobile banking app and control where their information is used

- Wells Fargo's latest move in the crusade to give customers control of their data signals the overall industry shift to building emotional loyalty by offering customers' choice of how they use their money