Data, Member Exclusive

A story of two Pauls: Financial wellness, credit scores and data

- Paul Diegelman and Paul DeSaulniers talk about improving consumer financial health.

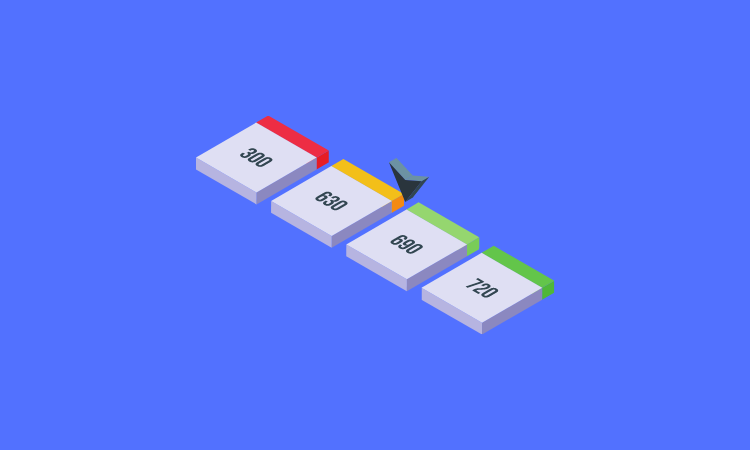

- Fiserv’s integration with Experian Boost allows Boost to pull billing data and add it to consumer credit profiles to improve their credit scores.