The password problem and the biometric fix

- Password habits may be a main culprit behind why consumer accounts get compromised as over a third of people admit to using weak and repeated passwords across sites.

- Given the vulnerability and inherent friction of passwords, some companies like Mastercard and American Express are moving decidedly in another direction: biometrics.

Last month Payoneer customers in Argentina were hit with a phishing attack that started from receiving a link for a password reset and resulted in customers losing their funds. A spokesperson from the company said that the attackers were able to target a “limited” number of customers but that the company acted quickly to contain the attack surface.

But passwords leading to account takeovers and loss of funds is a problem Americans can relate to, since 46% report having their password stolen in 2023. Password habits may be a main culprit in why consumer accounts get compromised as 35% of consumers state they use weak passwords and 30% admit to repeatedly using a password across platforms.

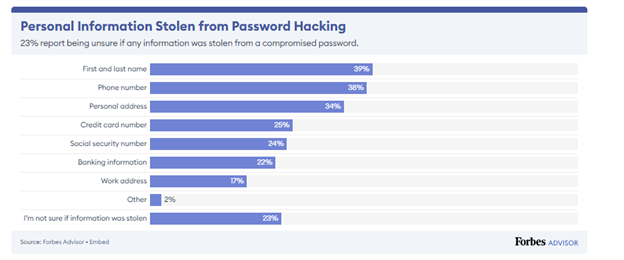

Once bad actors are in, customers are likely to lose an array of personal information. 24% of customers report losing their social security number and 25% losing their credit card number in attacks.

Considering that users tend to lose money and personal information, why do consumers use weak passwords or use them repeatedly across platforms?

One answer may be that passwords are a design problem, not just a security one.