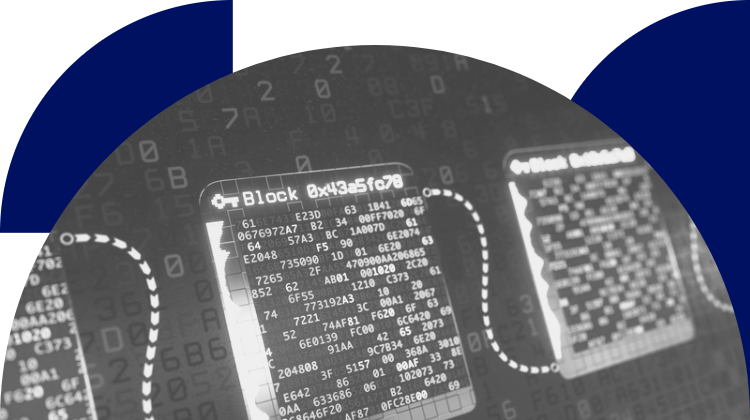

Blockchain and Crypto

SWIFT is taking the job of interlinking CBDCs across the world into its own hands

- With countries around the globe experimenting with CBDCs, the digital currency solution is set to grow in popularity over the next few years.

- To avoid fragmentation in upcoming solutions, SWIFT is experimenting with an interlinking solution that connects its current architecture to CBDCs.