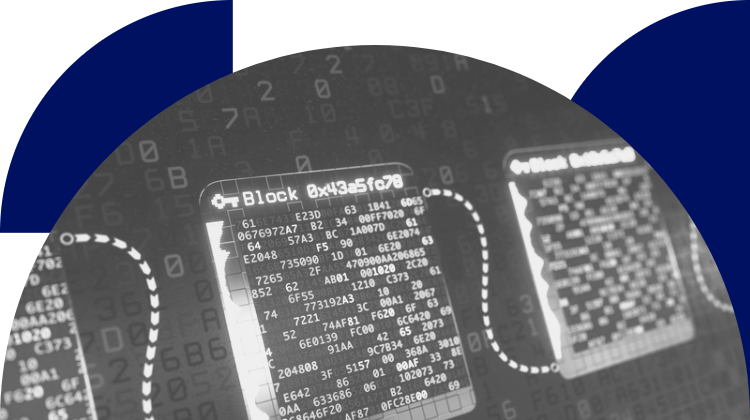

Blockchain and Crypto

5 questions with Fireblocks’ Michael Shaulov

- Fireblocks works with many of the largest global banks on blockchain and digital asset projects.

- We asked co-founder and CEO Michael Shaulov some questions.