Building bridges: How foundational tech investments can shape a more connected banking ecosystem, feat. U.S. Bank’s Scott Beyer

- How can FIs step in with solutions that allow SMBs to concentrate on growing their businesses while relegating banking to the background?

- During Tearsheet’s The Big Bank Theory Conference, Scott Beyer, U.S. Bank’s Head of Business Banking Digital Experiences, outlined three crucial steps that banks can take to capitalize on opportunities and minimize gaps in the SMB landscape.

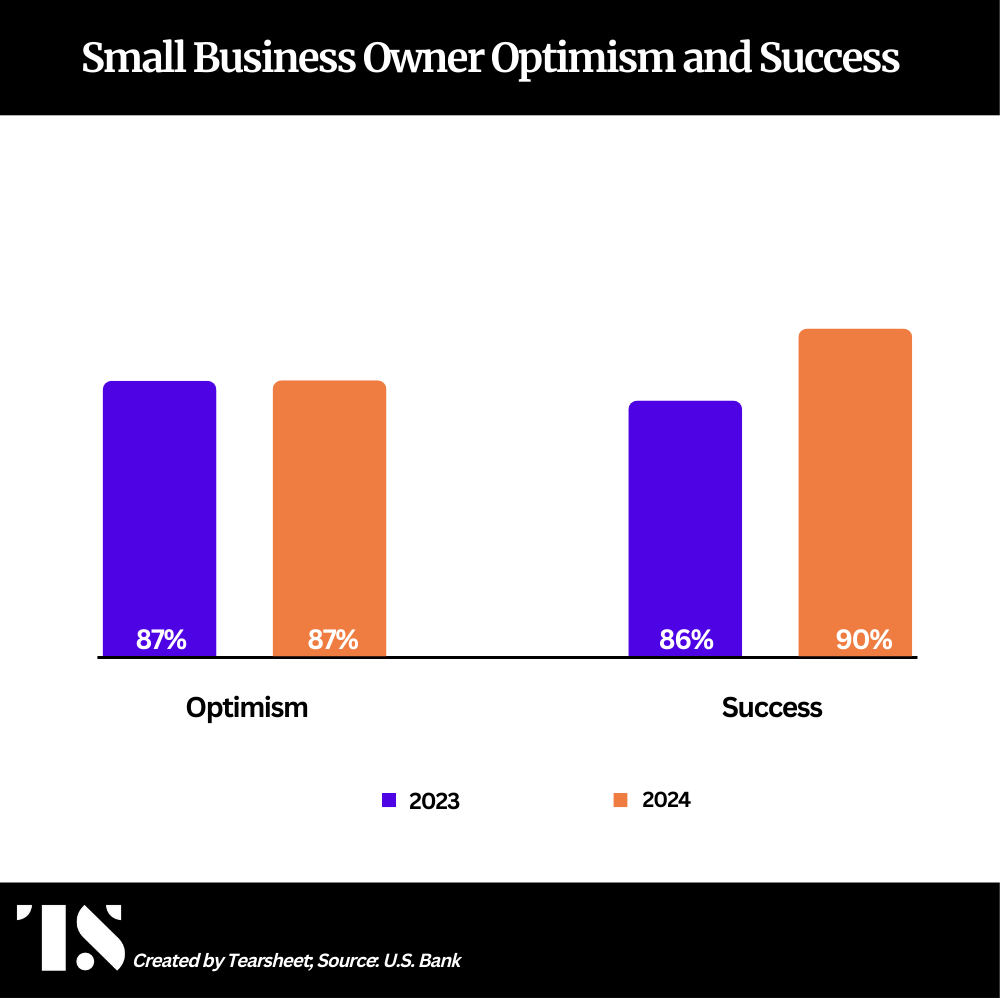

A recent survey by U.S. Bank reveals that the majority (87%) of small business owners are hopeful about the future of their companies, with many (73%) reporting growth. This growth occurred even as over half (52%) acknowledged experiencing labor shortages, and more than three-quarters (77%) reported navigating a highly competitive labor market.

So, how are SMBs finding ways to sustain their growth amid these challenges?

Shruti Patel, the Chief Product Officer for the Business Banking Segment at U.S. Bank, told me that small business owners adapt and thrive amid challenges. Many SMB owners attribute their success to essential skills like work ethic, and leadership, in addition to adaptability. They cope with work stress by staying connected to their purpose and adopting proactive strategies and work habits, which are crucial ingredients of their resilience.

However, some hurdles remain in the way.

The two key challenges that SMBs consistently face are time and supply chain concerns. These limitations push most small business owners and their teams to wear many hats, leaving little opportunity to dedicate time to the creative and growth-oriented aspects of their business that initially inspired their entrepreneurial journey. Whittling it down, securing a line of credit, and handling cash flow are recurring issues for these businesses. These banking-related issues, though critical, can consume owners’ energy daily and might cut into their overall business income.

This brings us to the next question: how can financial institutions step in with solutions that alleviate these pain points, allowing SMBs to concentrate on growing their businesses while relegating banking to the background?

“I think there are a few elements of that, but since SMB customers are willing to adopt technology, that’s a start,” said Scott Beyer, U.S. Bank’s Head of Business Banking Digital Experiences during Tearsheet’s The Big Bank Theory Conference, held recently in New York.

Beyers noted that a generational change is underway in the SMB landscape, with 77% of small business owners now adopting or planning to adopt technology to enhance their operational efficiency. This trend presents a valuable opportunity for FIs to enter the scene and create engaging digital experiences that resonate with the evolving needs of these businesses.

He identified three key steps banks can employ to seize the opportunity and address existing gaps:

- ensure the availability of products and services

- build integrations

- focus on data reconciliation and harmonization