With roboadvisors all over the news, one of the incumbent brokers is quietly chugging ahead with its own offering. In its recent earnings report [pdf], Schwab disclosed that its Schwab Intelligent Portfolios had grown its assets from $3 billion to $4.1 billion, a 37% jump in AUM quarter over quarter. That’s a big jump and a quick approbation from Schwab customers only a quarter in the business. Schwab’s strategy of launching a robo product appears to paying off.

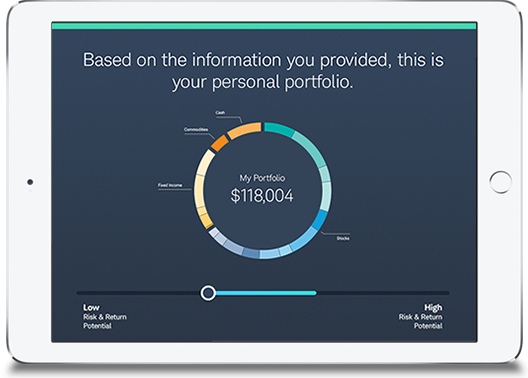

Charles Schwab ($SCHW) launched its roboadvisor offering, Schwab Intelligent Portfolios, in March of 2015. SIP goes head-to-head with similar offering from Wealthfront and Betterment. One of the main differentiators noted when Schwab launched its robo product was its fee structure: Schwab Intelligent Portfolios don’t charge any advisory fees, commissions or account services fees. The algorithms behind SIP choose from an investment universe of 54 available exchange-traded funds (ETFs), including Schwab’s own in-house ETFs. This represents 20 different asset classes, including stocks, bonds, emerging markets, real estate investment trusts (REITs) and commodities.

If you look outside Schwab, SIP was received with some skepticism from the market. Some reviewers complained that the firm’s use of its own products (ETFs and cash), as well as overweighting the cash component of its allocation model, will actually drive up costs for investors using Intelligent Portfolios.

Schwab entering the roboadviosr race is a big deal, as it brings tremendous resources (both technological, marketing, and customer-wise). Both Betterment and Wealthfront quickly responded by explaining how their offerings we’re superior (see Betterment’s benchmark vs. Schwab and Wealthfront CEO Adam Nash’s “reflection” on Schwab’s launch and Schwab’s subsequent response).

Where’s the growth coming from?

It was a very volatile quarter for the markets — in fact, hedge funds saw their largest outflows since the financial crisis of 2008. While Schwab didn’t disclose how it grew its assets over the quarter, current Schwab investors would be the most appropriate marketing targets, as they have their money already custodied with Schwab and appreciate the brand. A simple call, email, or message on the Schwab website may resonate for a self-directed investor looking for more personalized (albeit, automated) advice.

How did Schwab Intelligent Portfolios perform?

As a public company, Schwab has certain regulatory responsibilities in terms of quarterly reporting. With its Intelligent Portfolios, the company has published a quarterly summary of the market’s performance during the period as well as a qualitative performance review of Schwab Intelligent Portfolios.

Declines in many asset classes resulted in negative portfolio returns across the risk spectrum for the quarter. As would be expected in this environment, more conservative portfolios benefited from their larger allocations to cash and bonds, while more aggressive portfolios saw bigger declines as a result of their higher allocations to stocks.

In even the most aggressive portfolios, however, allocations to defensive asset classes helped temper declines. Diversification provided by asset classes such as U.S. REITs also generated positive returns, helping offset declines in stocks.

There aren’t any real numbers here to make sense of the quarterly performance, so it’s hard to really tell how SIP investors fared during this tumultuous time. Since the S&P suffered its largest decline in 4 years (-6.44%), market returns didn’t power Schwab’s growth in AUM. Instead, organic growth of new investor capital drove Schwab’s 37% quarterly increase.